BLOOMFIELD HILLS – While national venture capital investing decreased in 2022, Michigan continued to show strength with $1.2 billion invested into Michigan-based companies–an increase of 12 percent over 2021.

Within the Great Lakes region, Michigan has been accelerating in venture capital activity with a growth rate of 13.7 percent since 2006, slightly higher than the region’s overall 11.7 percent and the national rate of 10.8 percent, says a new report from the Michigan Venture Capital Association.

The MVCA released its 2023 MVCA Research Report Wednesday, a comprehensive analysis of investment activity that has had a positive impact in the state.

The 2023 MVCA Research Report highlights a downward trend in funding for the earliest-stage startups which demonstrates the need to increase the amount of capital available in Michigan to ensure the success of companies at all levels. The report highlights the need for the State of Michigan to invest in resources to maintain and grow a strong pipeline through all stages of growth and funding in support of new companies.

“After an unprecedented 2021, U.S. venture capital activity declined significantly in 2022 amid macroeconomic instability,” said Dan Kidle, Managing Partner at Arboretum Ventures and Chair of the MVCA Research Report Committee. “With this backdrop, our state showed resilience with investment activity above 2021’s record-breaking total. This further demonstrates that the venture capital ecosystem’s staying power is critical to Michigan’s economy.”

Some additional key findings from the 2023 MVCA Research Report include:

• $1.2B was invested into Michigan-based venture-backed startups across 164 deals.

• Total venture capital funds under management of firms headquartered in Michigan in 2022 was $5.9 billion, an 451

percent increase over a 10-year period.

• There were 13 exits by Michigan VC-backed startups in 2022, which is near the historical average but a decline from

a record-breaking 2021.• Every dollar invested in a Michigan startup by a Michigan venture capital firm during 2022 attracted $30.68 of

investment from outside of Michigan.

• There are currently 37 active venture capital investment firms in Michigan—a 63 percent increase over the last ten

years.

• In 2022, Michigan ranked second in total assets under management ($5.9B) in the Great Lakes region.

• Michigan-based venture capital firms have $640 million in dry powder available for new and follow-on investments,

but are bracing for a more challenging fundraising environment ahead.

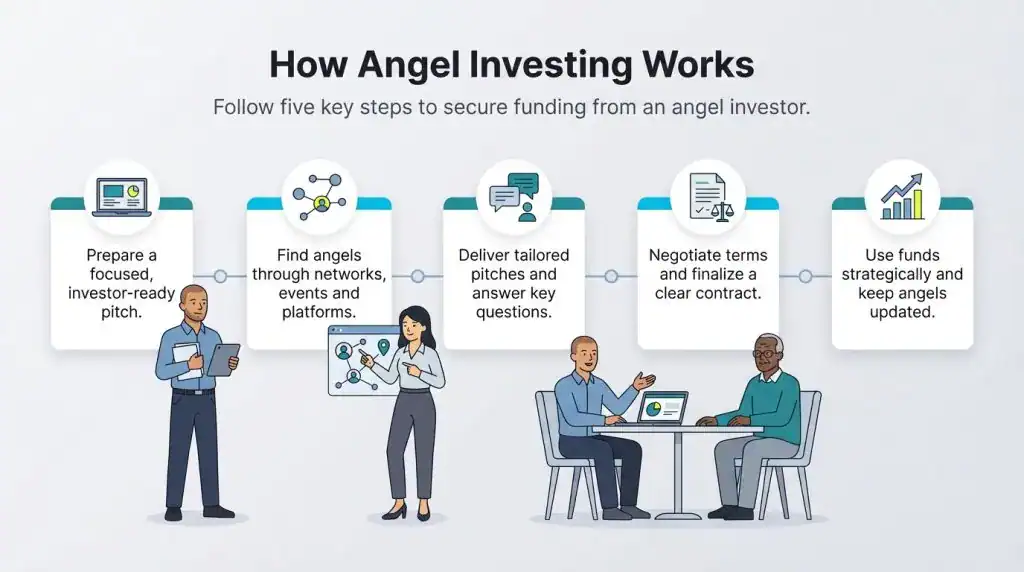

• In Michigan, 79 startups raised over $46.3 million from angel investors in 2022.

“Michigan has a strong pipeline of founders at all stages of growth; however, we must continue attracting more capital to fund the future. Michigan is home to some of the finest entrepreneurs in the country and having the ability to properly provide adequate support is a must for our sustainability,” said Ara Topouzian, MVCA Executive Director.

MVCA partnered with PitchBook, Crunchbase, National Venture Capital Association, Michigan Angel Fund, MVCA

members and HOUR Media to create the 2023 Research Report.

MVCA is a nonprofit trade organization founded in 2002 to increase the amount of capital and talent available to venture and angel investors for the funding of Michigan’s most innovative entrepreneurs.

The organization works closely with entrepreneurs to transform breakthrough ideas into new companies and industries that drive Michigan job creation and economic growth. MVCA membership includes private and corporate venture capital funds, angel investors, universities and economic development organizations, and service providers.

For more information, visit MichiganVCA.org.