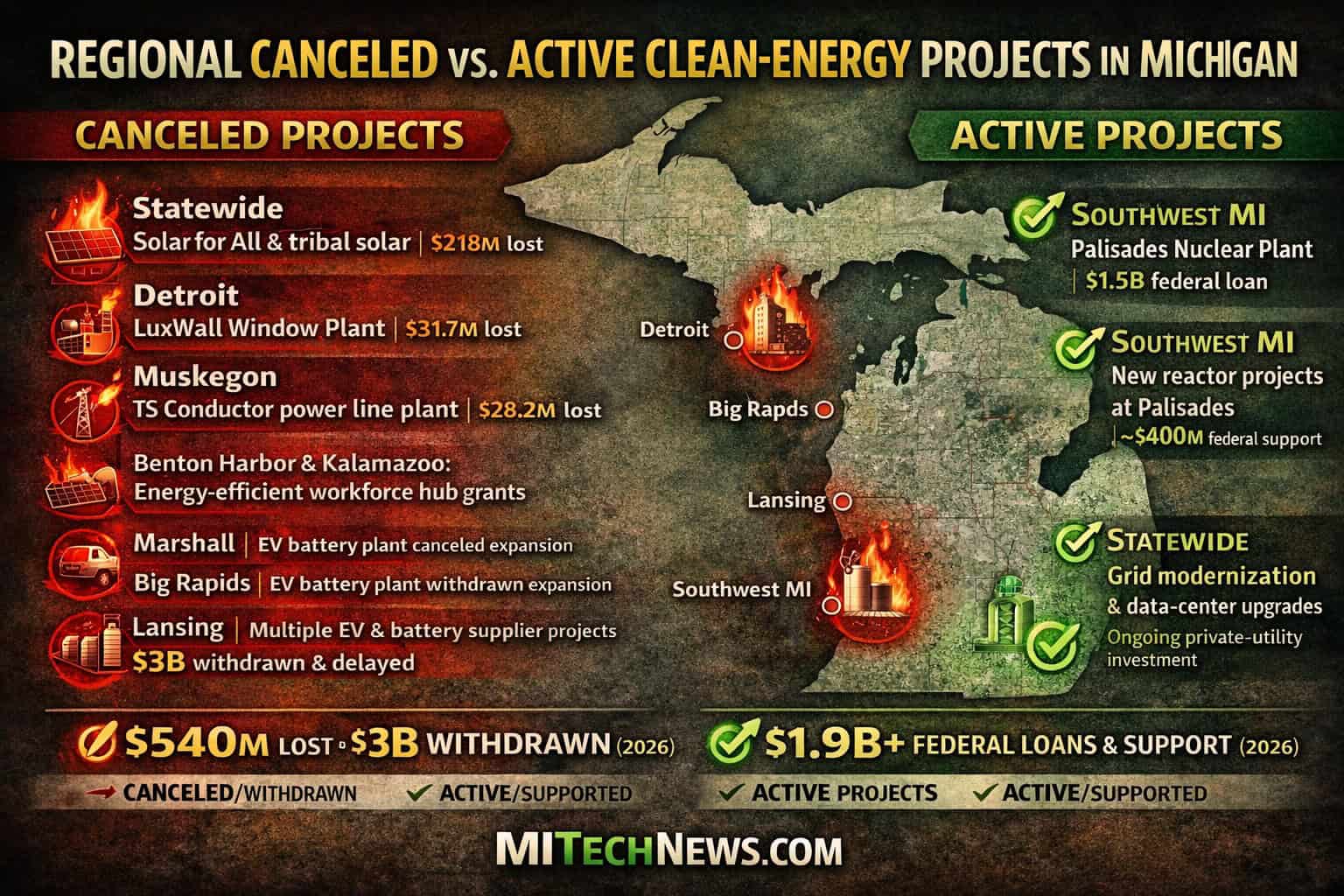

LANSING — Michigan’s clean-energy economy is entering a more fragmented phase after the state lost roughly $540 million in federal climate-related grants, triggering a pullback in several high-profile renewable and green-manufacturing projects while other energy investments continue to move forward.

The funding losses follow a shift in federal priorities in 2025 that froze or terminated dozens of grants tied to solar, energy efficiency, and climate equity programs. At the same time, federal and private capital has continued to flow into select sectors such as nuclear power and grid infrastructure, creating a clear divide between canceled and still-active investments.

Canceled vs. Active Clean-Energy Projects in Michigan

Canceled / Frozen Projects

| Project | Sector | Federal Funding Lost | Status |

|---|---|---|---|

| Solar for All (statewide) | Solar / Energy Equity | $156M | Canceled |

| Tribal Solar & Energy Equity Programs | Solar / Tribal Energy | $62M | Canceled |

| LuxWall energy-efficient window plant (Detroit) | Green Manufacturing | $31.7M | Canceled |

| TS Conductor high-capacity power line plant | Grid Manufacturing | $28.2M | Canceled |

| Faith-based climate resilience hubs | Community Resilience | $20M+ (combined) | Canceled |

| Energy-efficient housing workforce grants | Workforce / Housing | Tens of millions | Canceled |

| Multiple EV & battery supplier expansions | EV / Batteries | ~$3B (private + public) | Withdrawn or delayed |

Active / Moving Forward Projects

| Project | Sector | Investment / Support | Status |

|---|---|---|---|

| Palisades Nuclear Plant restart | Nuclear Energy | $1.5B federal loan | Active |

| New reactor development at Palisades | Nuclear Energy | ~$400M federal support | Active |

| Grid modernization & transmission upgrades | Grid Infrastructure | Utility + private capital | Active |

| Select advanced manufacturing (non-climate branded) | Industrial / Automation | Private investment | Active |

| Data-center-driven power infrastructure | Energy / Tech | Utility-backed | Active |

What the Split Reveals About Michigan’s Energy Strategy

The table highlights a key shift: projects branded explicitly around climate policy and equity were the most vulnerable, while investments tied to reliability, national security, and industrial capacity have largely survived.

Solar and efficiency programs — particularly those dependent on Environmental Protection Agency grants — suffered the deepest cuts. Michigan’s planned $156 million Solar for All rollout, which would have expanded rooftop and community solar in underserved areas, was halted alongside tribal solar programs and workforce initiatives that had already begun hiring and project planning.

At the manufacturing level, the loss of federal support derailed projects meant to rebuild domestic supply chains for energy-efficient construction and power transmission — including the Detroit-based LuxWall plant and TS Conductor’s high-capacity transmission line factory.

Nuclear and Grid Infrastructure Emerge as Winners

By contrast, nuclear energy has emerged as one of the clearest winners in Michigan’s evolving energy mix.

Federal backing for the Palisades nuclear facility — including a $1.5 billion loan to restart the plant and an additional $400 million commitment tied to new reactor development — underscores a broader national pivot toward always-on, carbon-free power capable of supporting industrial growth, electrification, and data-center demand.

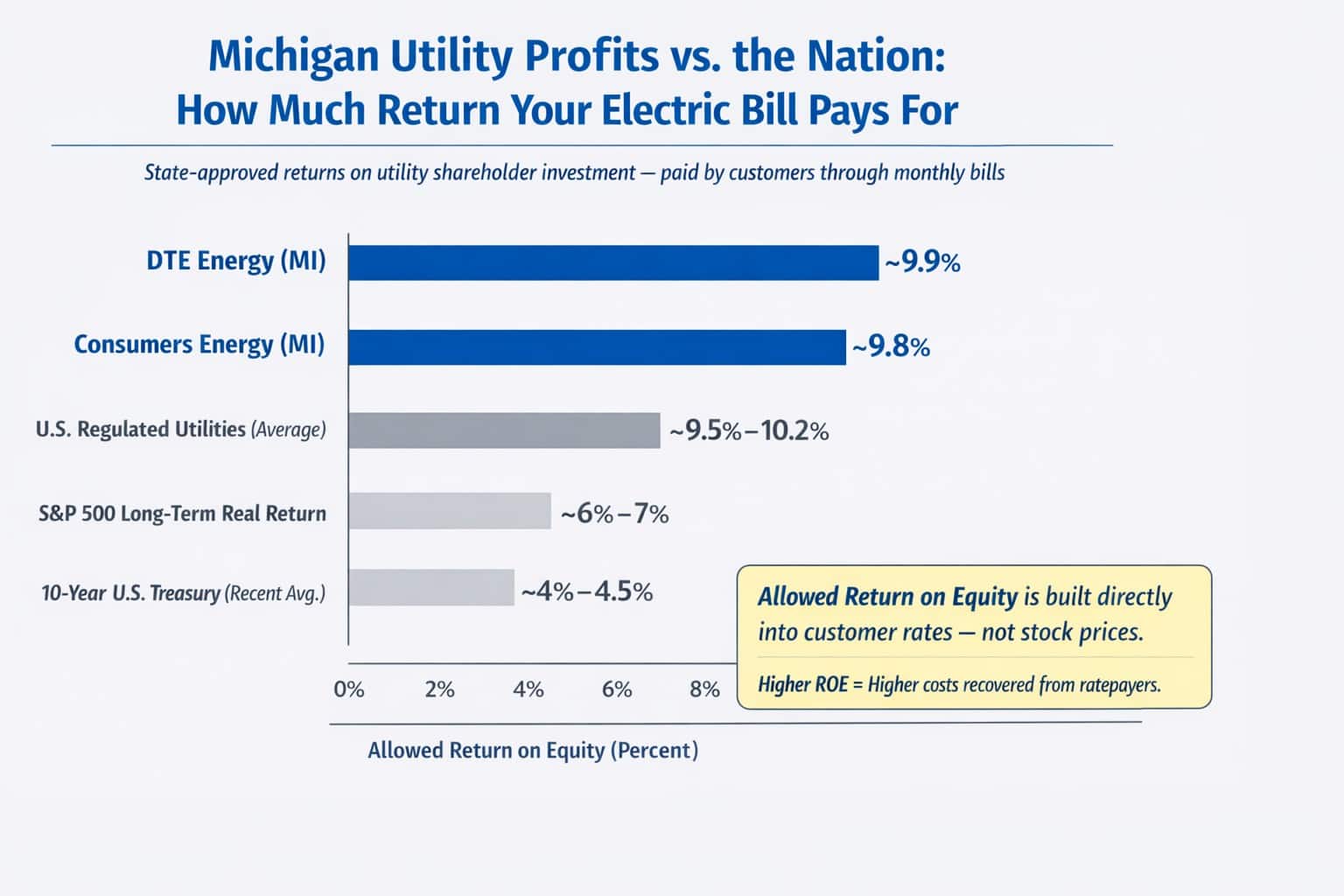

Grid infrastructure projects have also remained active, driven less by climate policy and more by necessity. Rising electricity demand from AI data centers, EV charging, and advanced manufacturing has kept utilities focused on transmission upgrades, even as grant-funded manufacturing components were cut.

Policy Risk Now a Central Factor

The diverging outcomes underscore a new reality for Michigan businesses: federal policy risk is now a decisive factor in project viability.

Projects tied directly to climate equity and renewable deployment proved most exposed to abrupt funding reversals. Meanwhile, investments framed around grid reliability, energy security, and industrial competitiveness retained support.

Michigan Attorney General Dana Nessel has joined multistate legal challenges arguing that the grant terminations violate congressional authority. Even so, developers say the uncertainty alone has already altered investment decisions and slowed new announcements.

The Bigger Economic Impact

Michigan entered 2025 with one of the nation’s most ambitious clean-energy pipelines. The loss of $540 million in grants — and roughly $3 billion in related private investment — does not erase that progress, but it reshapes the trajectory.

Workforce pipelines tied to solar and efficiency are now under strain. Communities that planned around grant-funded projects face gaps. Manufacturers are reassessing whether Michigan remains the best location for climate-linked investments.

At the same time, nuclear energy, grid infrastructure, and select industrial projects are becoming the new anchors of Michigan’s energy economy — more politically durable, but narrower in scope.

Michigan’s Clean-Energy Crossroads

Michigan’s challenge heading into 2026 is no longer whether clean energy matters, but which kinds of clean energy can survive shifting federal priorities.

The state now faces a strategic decision: how to rebuild momentum in solar, efficiency, and workforce development while recognizing that future growth may depend more heavily on energy reliability, grid strength, and industrial resilience than on climate branding alone.