LANSING — Michigan regulators are reviewing a proposed deal that would transfer 13 aging hydroelectric dams from Consumers Energy to a private equity-backed buyer, a transaction critics warn could expose taxpayers and ratepayers to long-term financial and environmental risk if the infrastructure fails.

Consumers Energy has asked the Michigan Public Service Commission (MPSC) to approve the sale of its river dams to a subsidiary of Maryland-based Hull Street Energy for $1 each. Consumers would then enter a 30-year agreement to purchase the electricity generated by those facilities.

The question before regulators: Does the deal protect the public interest — or shift future liability away from a regulated utility and onto communities if something goes wrong?

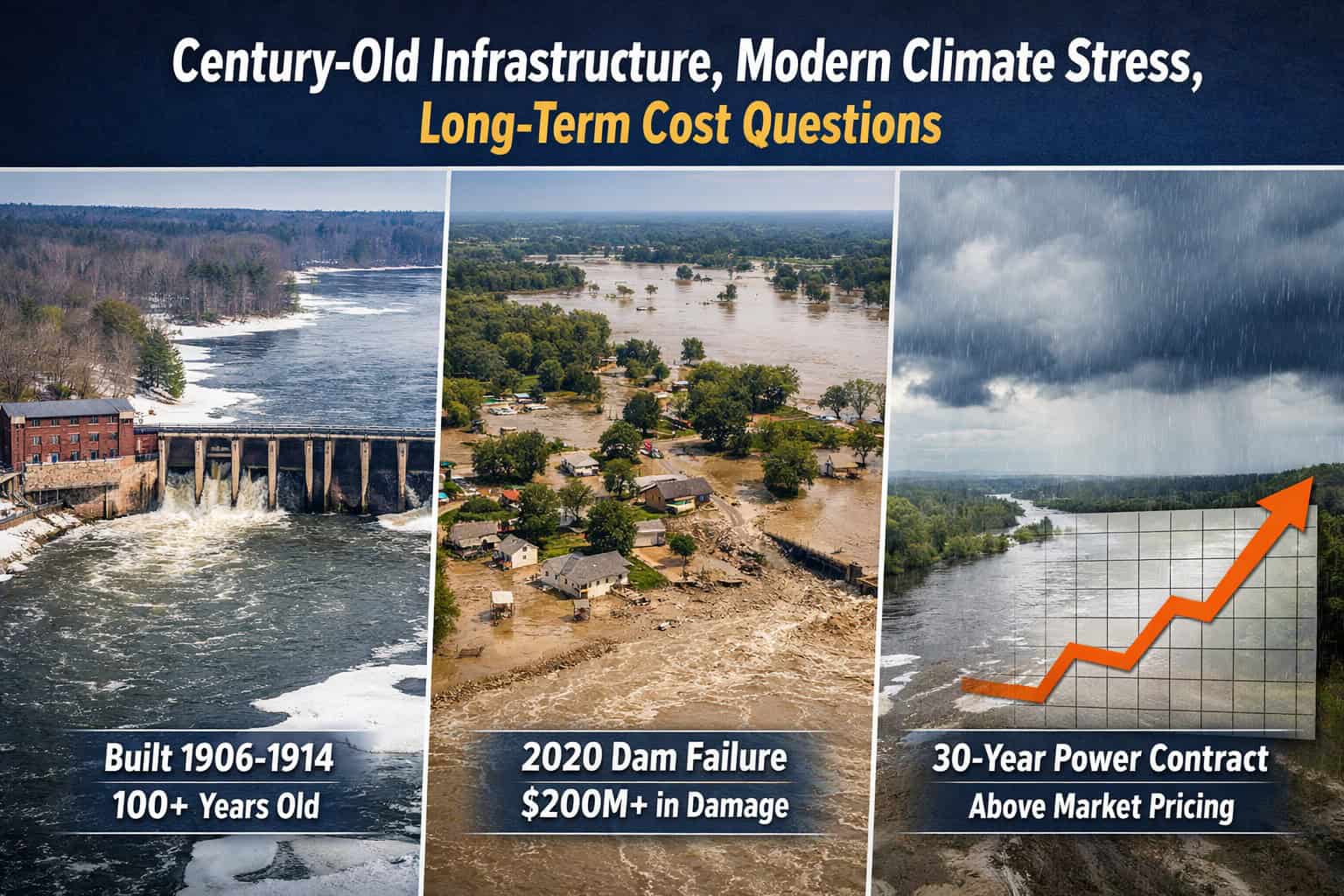

Built in the Early 1900s

Many of the dams included in the sale were constructed between 1906 and 1914 along Michigan river systems including the Au Sable and Manistee. That makes portions of the infrastructure more than 100 years old.

While dams can operate safely for decades with proper maintenance, older concrete structures require continuous inspection, spillway upgrades and structural reinforcement to meet modern engineering and hydrologic standards.

The Federal Energy Regulatory Commission (FERC) oversees hydroelectric licensing and safety compliance. However, in testimony filed in the contested case, MPSC staff raised concerns about “stranded asset” risk — infrastructure that may require significant reinvestment beyond what a future private owner is prepared or obligated to fund.

The core issue is whether sufficient financial safeguards exist to ensure long-term repairs, upgrades or potential decommissioning costs are covered.

Lessons From 2020

Michigan has already seen what can happen when aging dams fail.

In May 2020, the Edenville Dam and Sanford Dam collapsed following heavy rainfall, triggering catastrophic flooding in Midland and surrounding communities.

Damage estimates exceeded $200 million. More than 10,000 residents were evacuated.

The dams were privately owned, and years of regulatory and financial shortcomings preceded the failure.

While the Consumers dams differ in oversight and licensing, opponents of the current deal argue that the Edenville case demonstrates how infrastructure risk can ultimately spill into public hands when private operators lack adequate capital reserves.

Climate Adds Pressure

Michigan has experienced increasingly intense rainfall events over the past decade. Heavier storms place greater stress on spillways and embankments, particularly in older structures designed under early 20th-century engineering standards.

Dam safety experts note that climate variability increases the importance of ongoing capital investment and robust emergency planning.

Regulators reviewing the sale must weigh whether the proposed ownership structure ensures that level of investment for decades to come.

The 30-Year Power Contract

Under the proposed transaction, Consumers would purchase electricity from the dams under a 30-year contract starting at approximately $160 per megawatt-hour, with annual price escalators.

Energy analysts participating in the case have noted that current wholesale electricity prices in regional markets are lower.

In filed comments, Howard Learner, executive director of the Environmental Law & Policy Center, urged regulators to ensure “ratepayers are protected from uneconomic long-term commitments.”

Consumers Energy has defended the structure, stating publicly that the agreement preserves renewable energy generation while allowing a specialized hydro operator to manage the facilities. The company has also said the arrangement supports its broader clean energy transition strategy.

Who Pays if Something Fails?

If properly maintained and financed, the dams could continue operating safely for decades.

But if maintenance is deferred or extreme weather overwhelms infrastructure capacity, consequences could include:

-

Flood damage

-

Environmental remediation

-

Emergency response costs

-

Litigation

-

Ratepayer exposure through long-term contract pricing

MPSC staff testimony suggests regulators are examining whether bonding requirements, reserve funds or other financial guarantees adequately protect the public.

The debate is less about renewable energy — and more about liability.

Does the transfer truly shift risk to a well-capitalized operator?

Or does it create a scenario where aging infrastructure, climate stress and financial structure intersect in ways that could leave taxpayers exposed?

The Regulatory Decision Ahead

The Michigan Public Service Commission must determine whether the transaction meets the statutory “public interest” standard required for approval.

Regulators may impose additional conditions before issuing a final order.

At stake is more than ownership paperwork.

It is whether Michigan’s century-old dams — built during the state’s industrial expansion — remain securely maintained under new stewardship, or whether the financial structure surrounding them introduces long-term uncertainty.

If a dam fails in 2035 or 2045, the answer to one question will matter most:

Who pays?

The MPSC’s ruling will help determine that.