ANN ARBOR – The accelerating cost of climate change is no longer confined to distant coastal disasters or global economic forecasts. It is increasingly showing up in everyday household and business expenses — especially through higher insurance premiums, shrinking coverage options, and rising housing and operating costs.

While states like Florida and California are already experiencing insurance market breakdowns driven by hurricanes and wildfires, Michigan is not immune. In fact, data shows the financial impact of climate-driven storms, flooding, and infrastructure strain is already mounting across the state.

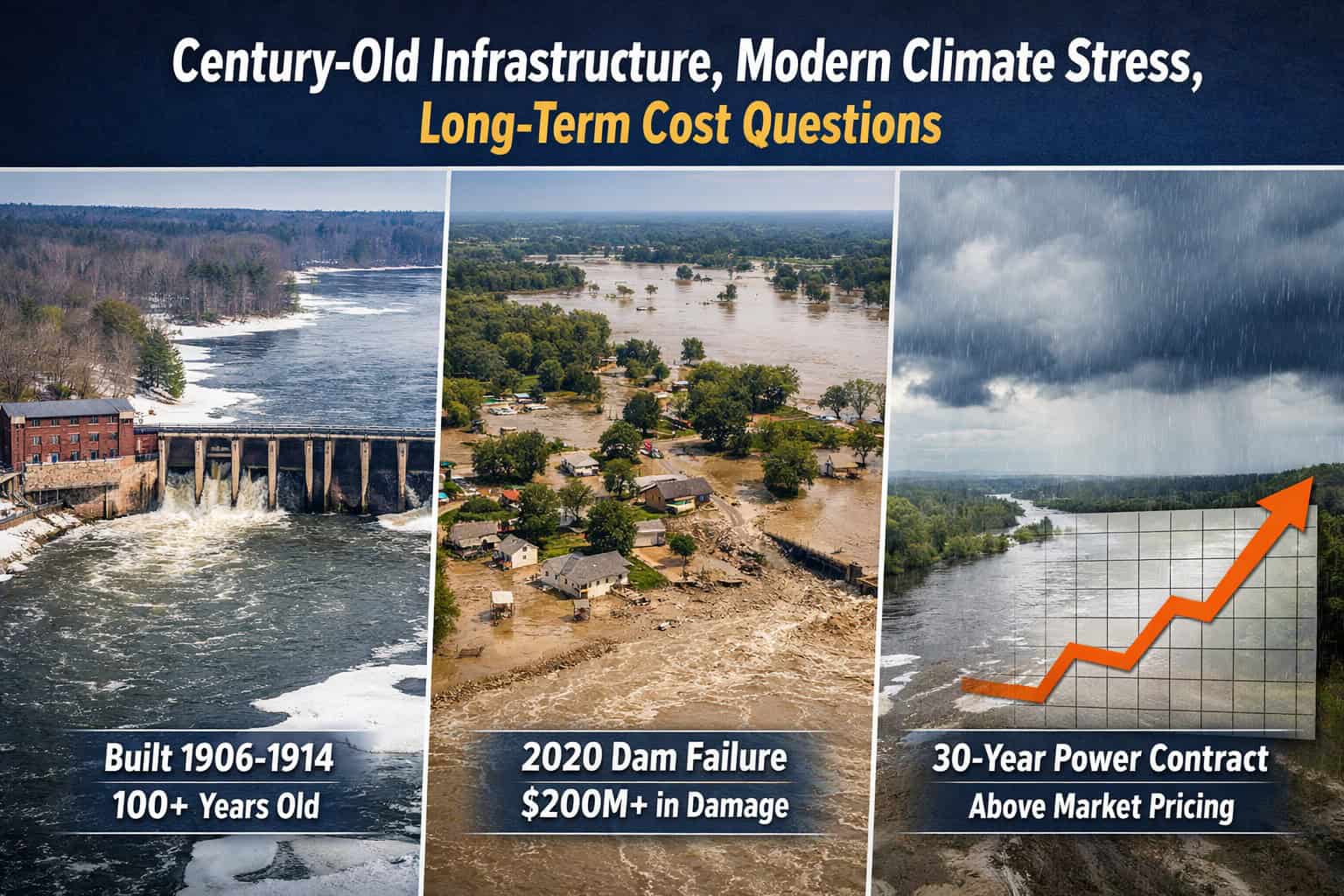

According to the National Oceanic and Atmospheric Administration, Michigan has suffered between $10 billion and $20 billion in total damages from billion-dollar weather and climate disasters since 1980, with the pace of losses accelerating sharply over the past decade. What were once considered rare events are now occurring with increasing frequency — and the costs are compounding.

Michigan’s Insurance Costs Rising Alongside Climate Risk

Michigan homeowners have historically benefited from relatively stable insurance markets. That buffer is thinning.

Heavier rainstorms, inland flooding, shoreline erosion along the Great Lakes, and more frequent severe storms are driving higher claims and larger payouts. Insurers are responding by raising premiums, tightening underwriting standards, and reassessing flood risk in areas that were once considered low exposure.

Nationally, homeowners insurance premiums jumped roughly 20% between 2022 and 2023, far outpacing inflation. Michigan insurers have followed the same trajectory, citing higher rebuilding costs, labor shortages, and climate-driven losses.

Flooding — now the most common and costly natural disaster in the U.S. — is a growing concern in Michigan. The 2014 Metro Detroit flood, for example, caused an estimated $1.8 billion in damage, damaging more than 100,000 homes across Wayne, Oakland, and Macomb counties. Many of those properties were outside officially designated flood zones, leaving homeowners underinsured or uncovered.

Lessons From Florida Offer a Warning Signal

The experience of Florida shows how quickly climate risk can destabilize insurance markets.

Florida homeowners now face average annual insurance premiums projected to exceed $15,000, nearly five times the national average. Multiple insurers have exited the state entirely, pushing homeowners into the state-backed Citizens Property Insurance Corporation, which has grown into one of the largest insurers in the country.

Michigan is far from that breaking point, but insurance analysts warn that unchecked losses — especially from flooding — can push any market toward instability if risks are not addressed early.

Higher Deductibles, Higher Exposure for Michigan Homeowners

Even when coverage is available, homeowners are being asked to shoulder more risk.

Insurers increasingly rely on percentage-based deductibles for storm-related damage. For a $300,000 Michigan home, a 2% to 5% deductible translates into $6,000 to $15,000 out of pocket before insurance coverage applies.

Federal Reserve research shows that even a $500 increase in annual insurance premiums is linked to higher mortgage delinquency rates. As insurance costs rise, housing affordability erodes — even in states like Michigan, where home prices remain below coastal levels.

Businesses Face Parallel Climate Costs

Michigan businesses are facing similar pressures.

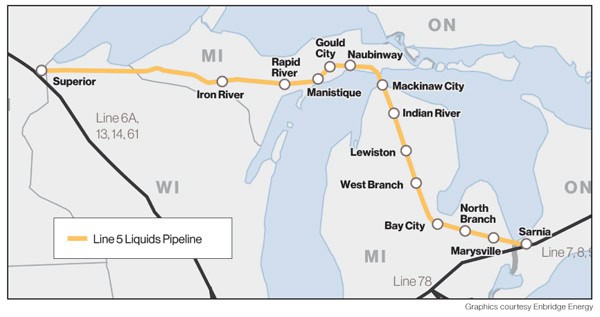

Commercial insurance premiums are rising for manufacturers, retailers, and logistics operators, particularly those located near floodplains, aging infrastructure, or Great Lakes shorelines. Higher premiums, tighter coverage limits, and rising deductibles translate directly into higher operating costs.

Reinsurance firms — which insure insurance companies — have also raised prices after consecutive years of record losses, a pressure that flows down to businesses and consumers alike.

For Michigan’s manufacturing-heavy economy, where downtime is costly and facilities are capital-intensive, climate risk is increasingly part of long-term planning discussions.

A Structural Shift, Not a Temporary Spike

The U.S. now experiences 20 or more billion-dollar climate disasters each year, compared with just a few annually in the 1980s. Experts say this represents a structural shift, not a temporary cycle.

Michigan’s own experience reflects that trend. Smaller events also add up: Grand Rapids suffered more than $10 million in damages during its 2013 flood, while recent severe storms and tornadoes have cost individual Michigan cities millions of dollars per event in cleanup, tree removal, and infrastructure repair.

In 2024, Michigan’s Disaster Emergency Contingency Fund ran a roughly $15 million shortfall, highlighting how repeated climate events are straining state and local recovery resources.

What Insurers Say Lowers Risk

Updated flood maps reflecting today’s rainfall

Sewer separation and stormwater retention systems

Elevated electrical systems and critical equipment

Shoreline stabilization and wetland restoration

Backup power and facility hardening for manufacturers

Bottom line: FEMA estimates every $1 spent on mitigation saves $4–$6 in avoided disaster costs.

What Prevention Looks Like in Michigan

The good news, experts say, is that many of the most effective prevention measures are well understood — and significantly cheaper than repeated rebuilding.

In Metro Detroit, aging combined sewer systems are routinely overwhelmed by intense rainfall. Regional planners estimate that Southeast Michigan alone needs more than $1 billion per year in stormwater infrastructure investment to keep pace with current rainfall patterns.

Along the Great Lakes shoreline, communities are increasingly investing in dune restoration, wetland buffers, and shoreline stabilization — measures that reduce erosion and flood damage at a fraction of the cost of repeated emergency repairs.

Updated flood mapping is another priority. Large portions of Michigan still rely on maps that underestimate today’s rainfall intensity, leaving homeowners and insurers exposed to surprise losses.

For businesses, insurers increasingly favor facilities that invest in resilience — elevating electrical systems, improving drainage, installing backup power, and protecting critical equipment. In Michigan’s manufacturing sector, these steps can mean the difference between remaining insurable or facing sharply higher premiums.

Federal emergency management studies consistently show that every dollar spent on hazard mitigation saves roughly $4 to $6 in avoided disaster costs.

The lesson from states already under insurance stress is clear: Michigan still has time to blunt the impact — but not indefinitely. Without sustained investment in infrastructure, updated risk data, and resilient design, climate costs will continue migrating from disaster headlines to monthly insurance bills, mortgage payments, and business balance sheets.