GRAND RAPIDS – A Grand Valley State University survey of West Michigan businesses and purchasing managers reveals increased uncertainty and a decline in confidence following the implementation of tariffs by President Donald Trump’s administration.

Brian Long, the director of supply management research at GVSU’s Seidman College of Business, said responses from March’s survey participants reflected a noticeable trend.

“One of the more disturbing results from this month’s survey is that a severe round of pessimism has taken hold,” Long said. “As little as five weeks ago, consumer confidence, even though it was falling, had not spilled over into our West Michigan survey.

“Well, that has come to an end. Our short-term business outlook index, which asks firms about their business perceptions for the next three to six months, posted the biggest drop we’ve had since the onset of the pandemic.”

As of March’s survey, the West Michigan economy is stable, Long said. Two of his key metrics — new orders (or business improvement) and production — remain strong.

“But, the economic environment has changed dramatically since late March, and we will need to watch our April survey results very closely to figure out where we’re going from here,” Long said.

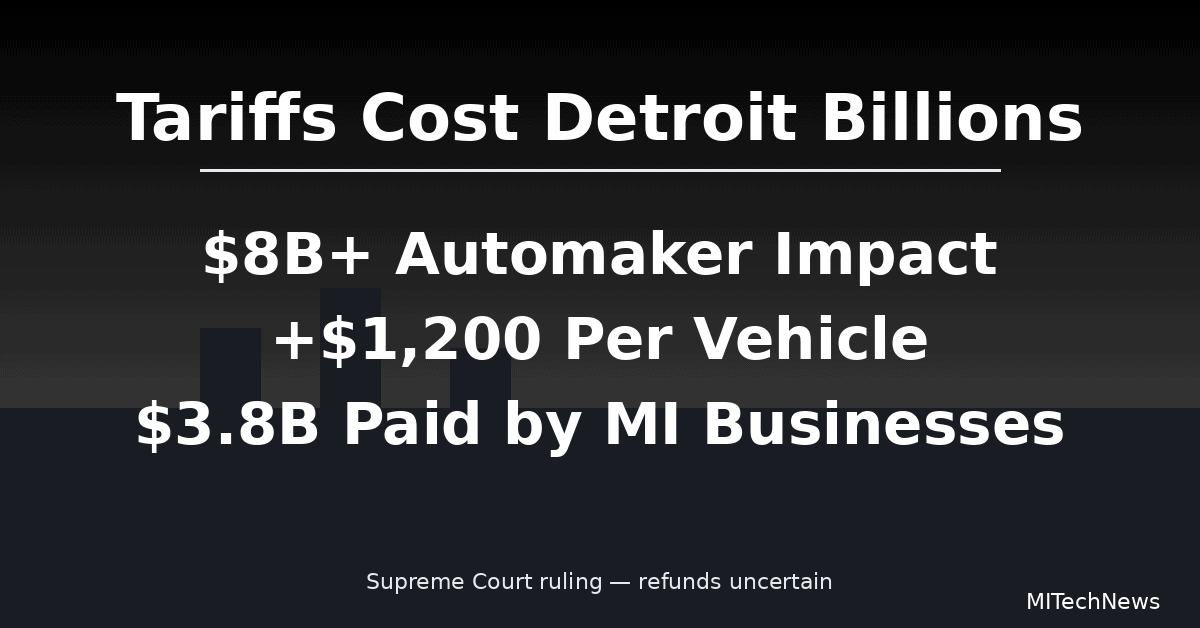

One sector facing vulnerability is the state’s and West Michigan’s auto industry, Long said. Given the international trade of auto parts and vehicles between Canada and the United States, the tariffs were not accounted for in the automakers’ business plans, Long said.

“One thing that most everybody agrees on is that major changes to the very foundation of our economy are occurring very rapidly, and no one can say with absolute certainty where we are going to be in, say, even the next few months,” Long said.

“The problem is that business planners hate uncertainty, so a lot of new investments, new hires, new programs have been put on hold, and if this degree of uncertainty continues for too long, it’s going to bite us.”

Here’s a look at the key index results from March’s survey of West Michigan businesses:

-

New orders index (business improvement): +10 vs. +11 in February

-

Production index (output): +13 vs. +1 in February

-

Employment index: -2 vs. -8 in February

-

Lead times index: 0 vs. -9 in February

More information about the survey and an archive of past surveys are available on the Seidman College of Business website.