ANN ARBOR – The artificial intelligence boom has a physical footprint — and it’s far larger than most people realize. Behind every AI model and cloud service are massive data centers operating 24/7, consuming enormous amounts of electricity. Once invisible to consumers, these facilities are now reshaping power grids, utility planning, and political debates nationwide.

In Michigan, that national debate is becoming increasingly local.

The AI Boom Meets the Power Grid

Data centers are no longer modest server rooms. Today’s hyperscale facilities can draw as much electricity as a small city, with near-zero tolerance for outages and rapidly escalating demand as AI workloads grow.

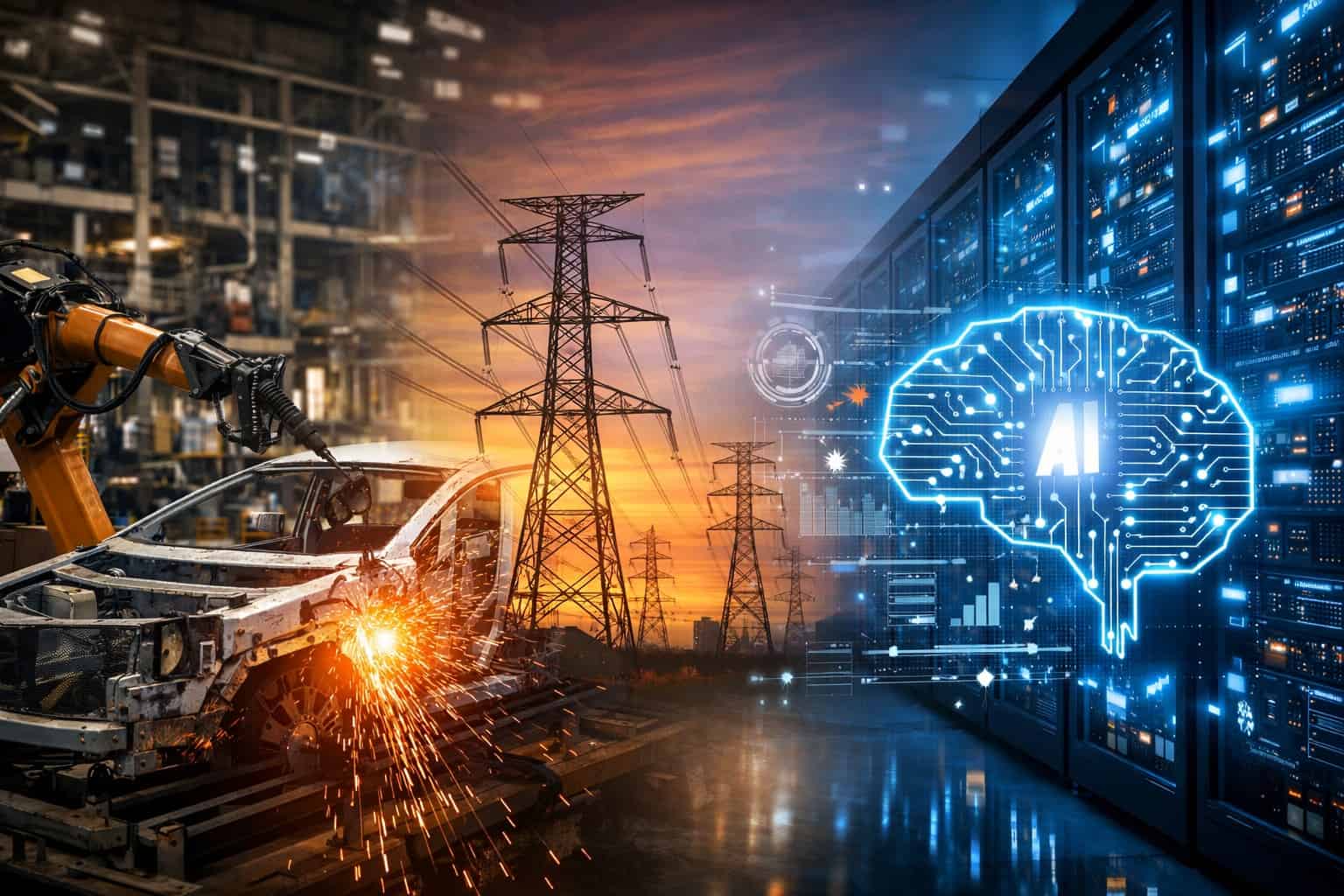

Nationally, grid operators warn that electricity demand tied to AI is arriving faster than expected, outpacing traditional planning models. That has forced regulators and utilities to confront a difficult question: who pays to upgrade the grid when demand is driven by some of the world’s wealthiest companies?

Washington’s Warning on Consumer Costs

At the federal level, support for AI infrastructure cuts across party lines, framed as essential to economic competitiveness and national security. But even as Washington pushes faster permitting and infrastructure development, concern is growing over rising utility bills.

President DTrump has publicly argued that technology companies must “pay their own way” when it comes to electricity demand, warning that Americans should not see higher power bills because of data centers.

That warning reflects broader political risk. Electricity costs are rising across much of the country, and voters are increasingly sensitive to anything that looks like corporate cost-shifting.

Why Michigan Is in the Crosshairs

Michigan has emerged as an attractive location for data centers. Large parcels of land, access to transmission infrastructure, and state-approved tax incentives have positioned the state as competitive with traditional data center hubs.

But the scale of proposed demand has caught regulators’ attention.

Regulatory filings show Consumers Energy has received data center inquiries that could eventually exceed 15 gigawatts of new demand — nearly double its historical peak load. DTE Energy has acknowledged discussions with developers representing multiple gigawatts of potential new demand.

Put simply, Michigan’s grid was not built for this kind of sudden, concentrated load growth.

Regulators Draw a Line on Ratepayer Protection

The Michigan Public Service Commission (MPSC) has responded cautiously, approving special power supply contracts for data centers only with strict conditions designed to prevent costs from being shifted onto residential and small business customers.

In a December 2025 order approving contracts between DTE Electric and a data center developer, MPSC Chair Dan Scripps said the commission’s decision was structured to ensure Michigan can capture economic benefits while keeping related costs off other customers’ utility bills.

The ruling reflects a broader regulatory concern: once infrastructure is built, it becomes difficult to unwind cost allocation if protections fail.

Economists Warn of Outsized Risk

Energy economists caution that data centers pose unique financial risks because of their scale.

Douglas Jester, an energy consultant with 5 Lakes Energy who regularly participates in Michigan utility cases, has warned that even small amounts of cost shifting tied to data centers could significantly impact residential rates. Because these facilities are so large relative to utility systems, modest miscalculations can ripple quickly through customer bills.

The Michigan Attorney General’s Office, led by Dana Nessel, has echoed those concerns in regulatory filings, warning that utilities could incur hundreds of millions of dollars in generation and transmission costs to serve data centers — costs that must be clearly assigned to those customers rather than absorbed by the broader rate base.

Utilities See Growth — and Obligation

Michigan’s utilities argue that data center growth is accelerating investments that were already necessary.

DTE Energy has expanded its five-year capital investment plan to more than $36 billion, citing rising demand and the need to modernize and harden the grid. Consumers Energy has similarly ramped up investments in renewables, storage, and distribution upgrades.

Utility executives say these investments benefit all customers by improving reliability. Critics counter that without strict oversight, residents may still end up underwriting infrastructure primarily designed to serve private, out-of-state users.

Community Pushback Builds

Beyond rates, local concerns are growing around land use, water consumption, noise, and environmental impact. In parts of rural Michigan, officials have considered moratoriums on data center development, citing infrastructure strain and limited local benefits once construction ends.

These debates mirror national trends, where communities increasingly question whether data centers — which employ relatively few workers long term — deliver enough economic value to justify their footprint.

What’s at Stake for Michigan

Michigan now sits at a critical junction.

Handled carefully, data centers could help anchor a modern digital economy while accelerating grid upgrades that support electrification and clean energy goals. Handled poorly, they risk becoming symbols of economic imbalance — where public infrastructure quietly subsidizes private wealth.

As AI reshapes the economy, the central question facing Michigan is no longer whether data centers will arrive, but under what rules — and at whose expense.

(Editor’s note: A deeper breakdown of Michigan data center demand, utility filings, and regulatory safeguards is available in a companion explainer linked here.)