WASHINGTON, DC – The U.S. venture ecosystem ended 2020 with more than 10,800 companies across the country receiving venture funding and approximately 1,965 VC firms managing 3,680 venture funds with $548 billion in assets under management (AUM), according to the National Venture Capital Association 2021 Yearbook, with data provided by PitchBook.

The NVCA 2021 Yearbook is an annual publication documenting trends and analysis of venture capital activity in the U.S. from the past year and presents historical data and information about venture’s role in fueling entrepreneurship in America.

In 2020, U.S. venture-backed startups represented over 4.4 million employees. The 10,862 high-growth startups that raised capital last year to build and grow their companies hailed from all 50 states and the District of Columbia, 233 Metropolitan Statistical Areas (MSAs), and 414 Congressional Districts. Total capital invested in the U.S. last year reached $164 billion and buoyed global total venture capital investment to $321 billion. The U.S. share of global venture investment has held steady around 50% the past five years—51% in 2020—but remains well below the 84% global share in 2004 and 90%+ share in the 1990s.

“Despite one of the most tumultuous years the U.S. VC industry and the nation have witnessed, VC made its own history this past year, displaying remarkable resilience in the face of profound headwinds and breaking numerous industry records,” said Bobby Franklin, President and CEO of NVCA. “While the industry initially focused on triage and husbanding capital during the initial stages of the pandemic, it came roaring back during the second half of the year to set records in fundraising, investments, and exits. Looking ahead to 2021, a key opportunity for the VC industry will be if the new Biden Administration and Congress enact key policies crucial to the startup ecosystem, such as a Startup Visa program and additional federal spending on basic research and development.”

Highlights of the U.S. Venture Industry in 2020

- Venture-backed exit activity hit new records in 2020 on the back of large IPOs during the second half of the year. The 103 venture-backed IPOs representing $222 billion in exit value in 2020 marked the highest annual exit value on record.

- The number of mergers and acquisitions (M&As) fell to 886 in 2020 (compared to 1,042 in 2019), but total disclosed exit value hit a record high of $75 billion, 9% greater than the previous 2014 high of $68 billion and 24% more than the $60 billion reported for 2019.

- 10,862 venture-backed companies received $164 billion in funding in 2020, the third consecutive year more than $130 billion has been invested.

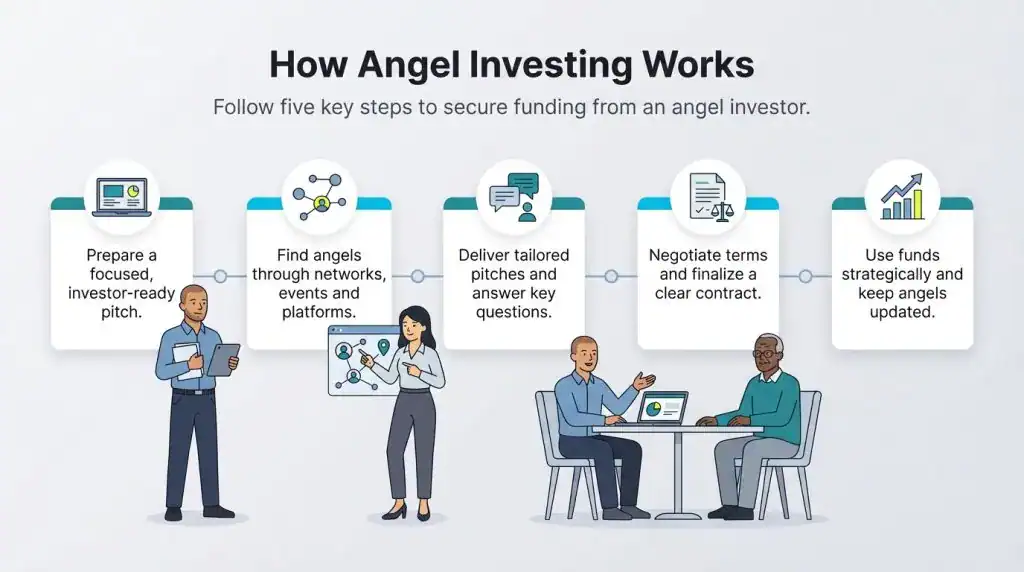

- The number of angel/seed VC investments in 2020 fell compared to 2019, with 4,859 deals completed, representing 42% of total deals in 2020. By comparison, there were 5,277 angel & seed VC investments in 2019, representing 43% of total deals that year.

- The number of first-time financings (i.e., first round of equity funding in a startup by an institutional venture investor) in 2020 was down relative to 2019 in terms of both capital invested and deal count. In 2020, $12.9 billion across 3,093 deals was invested in companies raising equity financing for the first time. By comparison, $13.1 billion across 3,328 deals was committed to first-time financings in 2019.

- The 327 mega-deals (i.e., investments of $100 million+ into venture-backed companies) recorded in 2020 is the highest annual deal count on record, and the $76 billion invested in mega-deals accounted for nearly half (44%) of the total VC capital invested in 2020.

- Pharma & biotech’s strong results buoyed a record year for life sciences because of investor interest in vaccines, antivirals, and companies engaged in the fight against COVID-19. $36 billion in capital was invested in life sciences companies in 2020, 41% more than the previous annual record of $26 billion invested in 2018. Investment in drug discovery nearly doubled from $8.8 billion in 2019 to $16.2 billion in 2020.

- Venture capital investors raised $74.5 billion across 339 funds to deploy into promising startups, marking the seventh consecutive year that $40 billion or more raised and the third straight year in which at least $55 billion was raised.

- The overall U.S. median VC fund size in 2020 was $75 million, the highest since 2008 and a 69% increase from 2019.

- The $548 billion in U.S. VC assets under management at the end of 2020 included a record $151 billion in dry powder.

- Startups that were venture-backed in 2020 represented over 4.4 million employees.

Venture Across the Country

- VC funds based in 35 states and the District of Columbia held final closes in 2020.

- The median VC fund size for California, Massachusetts, and New York, collectively, was $100 million – more than four times the $24.6 million median VC fund size for the rest of the nation.

- Venture funding reached startups in all 50 states and the District of Columbia, 233 Metropolitan Statistical Areas (MSAs), and 414 Congressional Districts.

- Winston-Salem, NC; Albuquerque, NM; Dover, DE; New Haven, CT; and Portland, ME saw the biggest growth rate for annual number of VC investments over the past five years (for those MSAs with at least 15 in 2020).

- Detroit; Dover, DE; Charlotte, NC; Columbus, OH; and New Haven, CT. saw the largest annual growth for VC investment over the past five years (for those MSAs with at least $10 million VC investment in 2016 and 2020).

NVCA in Action in 2020

- NVCA worked diligently to ensure COVID-19 relief resources provided by the government, such as the Paycheck Protection Program (PPP), Payroll Tax Deferral, and Refundable Employer Credit, were available for and usable by VC-backed companies.

- NVCA launched Venture Forward, its 501(c)(3) supporting organization, whose mission is to shape the future of venture capital for the better by promoting a strong and inclusive community through programming, education, and other resources that will empower the startup ecosystem’s ability to thrive.

- NVCA launched a ‘Startups Combating COVID-19’ campaign to highlight VC-backed startups helping address COVID-19 to policymakers and the general public. We then expanded this initiative later in the year with a ‘Venture Answers’ campaign to further spread the message that VC-backed companies are responding to the pandemic and are crucial to our country’s economic recovery.

- NVCA was thrilled to see a final rule released by several agencies that revises the Volcker Rule to once again allow banks to invest in venture capital funds. This reform to the Volcker Rule, for which NVCA has long advocated, is especially important to small and regional VC funds who have greater challenges raising capital and will put capital to work building startup communities around the country.

- NVCA delivered a strong schedule of virtual programming, including the Stanford/NVCA Venture Capital Symposium, the Strategic Operations & Policy Summit, the annual StratComm Summit focused on communications and public relations best practices, and also provided a host of COVID-19 information and resources for VCs and startups.

Download the NVCA 2021 Yearbook HERE. Access the public supplemental PDF data pack HERE. NVCA members may access the members-only supplemental XLS data pack by contacting [email protected].