GRAND RAPIDS — Michigan’s early-stage capital ecosystem continues to evolve as Michigan Capital Network (MCN) expands its statewide angel investing collaborative, adding a Lansing-based investor group and naming new leadership aimed at strengthening startup financing across the state.

Michigan Capital Network announced that Capital Community Angels (CCA) has joined its MCN Angel Association. At the same time, Emily Sarata has been named President of the MCN Angel Association and Director of Engagement for MCN.

The expansion increases coordination among regional angel investor groups at a time when early-stage companies face tighter national capital markets and heightened competition for funding.

“We have long regarded Michigan Capital Network and its angel association as an elite organization that shared many of the same principles and priorities that we focus on,” said Jeff McWherter, President of Capital Community Angels. “We believe joining their statewide organization will help our members support a wider array of entrepreneurs throughout the state.”

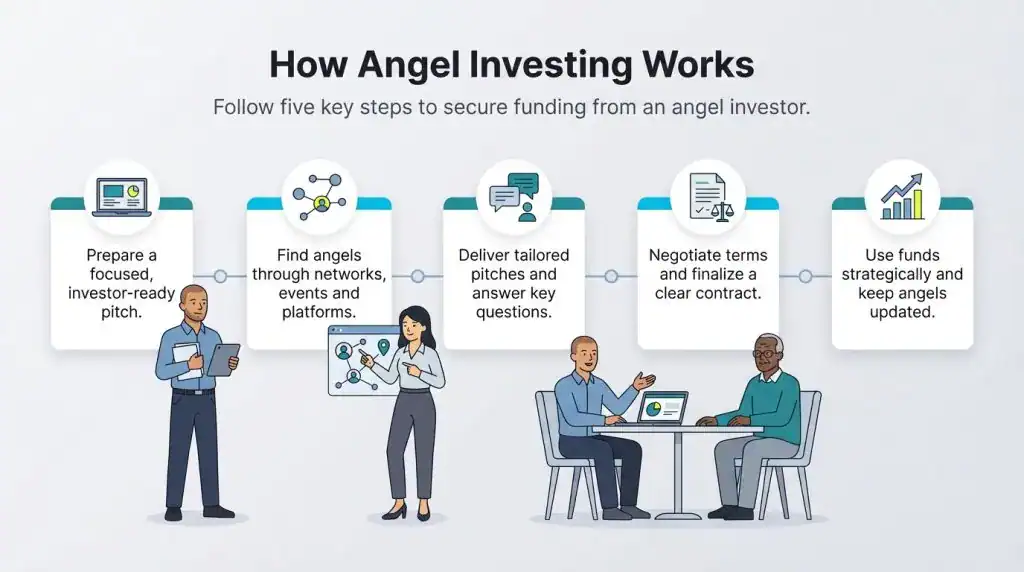

What Angel Investors Do — And Where They Fit

Angel investors are typically experienced executives or entrepreneurs who invest their own capital into early-stage companies. They operate between informal “friends and family” funding and institutional venture capital.

Here’s how the capital stack generally works:

Friends and Family Funding

The earliest capital raised to validate an idea or build a prototype. High risk and usually informal.

Angel Investment

Once a startup shows early traction — initial customers, revenue, or intellectual property — angels invest to help refine operations and scale. Angel checks often range from $25,000 to several hundred thousand dollars, frequently pooled through organized groups.

Venture Capital

Institutional VC firms step in when companies demonstrate scalable growth, deploying multi-million-dollar investments to accelerate expansion.

In short: friends and family fund belief. Angels fund validation. Venture capital funds scale.