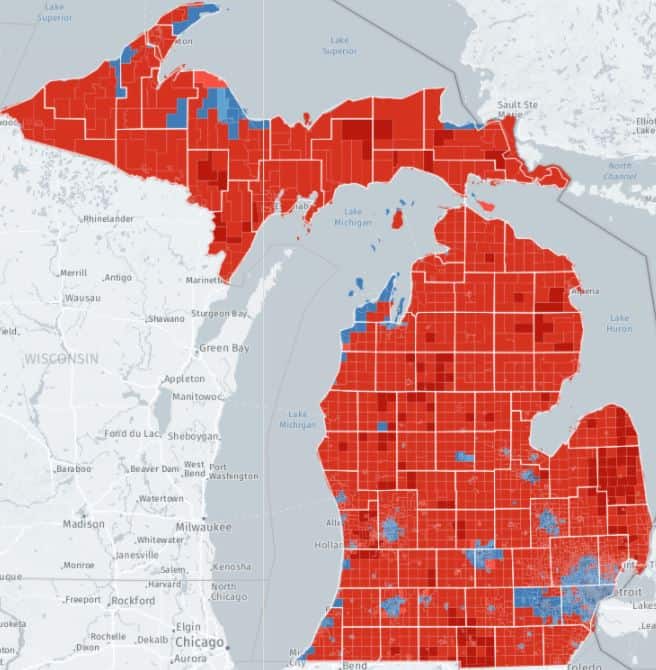

LANSING – A Michigan House subcommittee on Thursday moved a budget assuming $542.5 million from a forthcoming, dedicated transportation fuel tax that would eventually replace the 6 percent sales tax currently collected on fuel purchases.

House Speaker Lee Chatfield (R-Levering) has made it a priority to ensure all money charged at the pump goes to the roads. Sales tax dollars, though, go to schools and municipalities, which have opposed taking the sales tax off fuel.

The budget, HB 4246, was reported 5-2 with Republicans voting yes and the subcommittee’s two Democrats, Rep. Leslie Love of Detroit and Rep. Ronnie Peterson of Ypsilanti, voting no. The Democrats raised concerns about the forthcoming proposal and the potential loss of funding to schools and local governments through the sales tax changes.

“This budget leaves me with more questions than answers,” Love said.

Chatfield has pegged the School Aid portion of the sales tax charged on gasoline at roughly $600 million. Local governments get hundreds of millions as well through the sales tax revenue. The budget says additional legislation will be required for the tax portion and details were not immediately available.

“I have said from day one every cent that is paid as taxes at the pump needs to be a penny that goes toward roads,” Chatfield told reporters Thursday. “We can shift out the sales tax at the pump and replace it with a revenue-neutral gas tax to ensure the roads are getting $800 to $900 million annually. That is a responsible first step in ensuring our roads are properly funded.”

It is unclear exactly how the sales and fuel tax shift would be handled. House Appropriations Chair Rep. Shane Hernandez (R-Port Huron) said lawmakers could replace the sales tax with a wholesale fuel tax or an average of what the sales tax has been on fuel, which at present would equate to about 18 cents per gallon. Those specifics are still being discussed.

To hold the School Aid Fund “harmless,” Republicans in their budgets did not use any School Aid Fund dollars for higher education, keeping $494.3 million in the fund, and plan to reverse an income tax shift passed during lame duck to take sales tax increases from online purchases and use it for other things, which would keep roughly $170 million in the fund if it passes.

When asked if House Republicans were presenting Governor Gretchen Whitmer with a non-starter, Hernandez said, “We are going to have to wait to see what the reaction is.”

Whitmer offered little reaction Thursday, telling reporters it is still early in the budget process.

“The way we look at this, the way the speaker and I have been saying all along, we don’t want to have conversations on additional funding and other revenue until every penny paid at the pump goes to our roads,” Hernandez said. “We are taking that first step today and we are willing to continue working forward.”

Local governments also receive sales tax dollars and it is unclear how the revenue will be backfilled for locals. Hernandez said it would be clear as the budgets are worked on the House floor.

Jennifer Smith, with the Michigan Association of School Boards, said the group has remained opposed to taking the sales tax off fuel.

“It is a huge hit to School Aid revenue streams,” she said, adding keeping School Aid Fund money away from higher education is not necessarily permanent.

“It doesn’t mean the next time the state is in a tough place, they (don’t) go back to that idea,” she said.

Rep. Matt Maddock (R-Milford), chair of the House Appropriations Transportation Subcommittee, said during the subcommittee’s meeting Thursday that the House Republican plan would ensure all taxes paid at the pump go to roads in two years, redirecting 4 percent of the sales tax this year and 2 percent next year.

Overall, the budget is $5.4 billion, a 7.8 percent increase from current year. It is about $375 million less than Governor Gretchen Whitmer‘s recommendation.

Jeff Cranson, spokesperson for the Department of Transportation, said the state has the worst roads in the country and needs $2.5 billion in additional funding “to restore our roads and bridges and give drivers peace of mind that they are safe.”

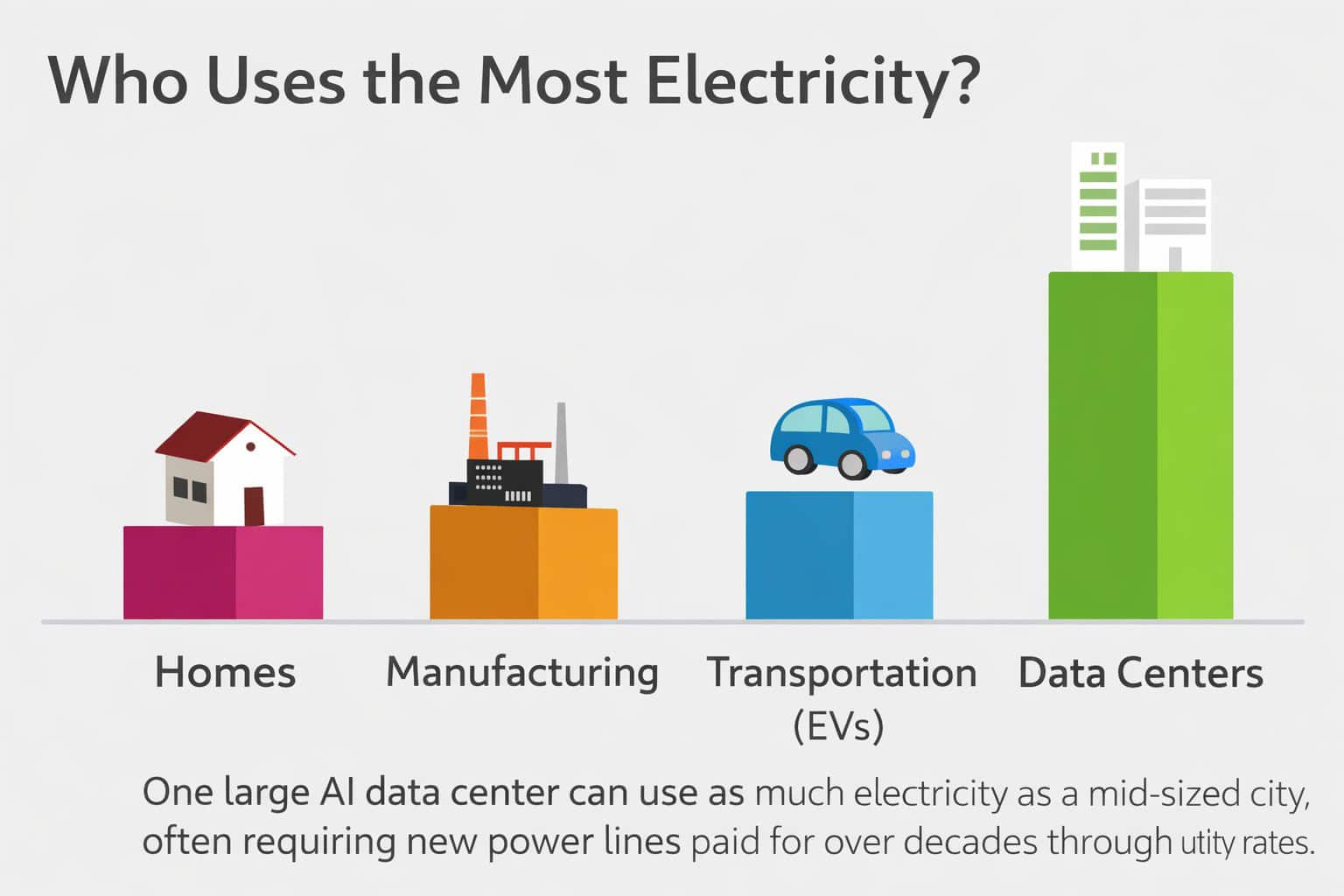

As the budget, like others in the House, makes a 25 percent cut to information technology services, Cranson said the department would have to look very hard to cut “at a time the driving public is demanding more efficiency than ever.”

“This will also have an impact on key processes that rely on up-to-date technology, like permitting and billing the federal government,” he said.

Love said she has serious reservations on the budget bill. She said it falls more than $700 million short of the $2.5 billion many say is needed annually to properly fund roads.

“We have not had the opportunity to ask nearly enough questions or examine this bill and the impact this proposed budget could really have. I remain concerned this budget could have serious consequences for our state,” she said. “The proposed funding not only hasn’t been vetted, contrasted with the governor’s recommendation that has been discussed and available for months. We have had this proposal in front of us for hours. This is a terrible way to craft public policy. It’s an irresponsible way to allocate the tax dollars of hard-working Michiganders.”

As expected, the budget includes boilerplate requiring the Department of Transportation to solicit proposals for a variety of state assets and operations, including the Amtrak service from Grand Rapids to Chicago, the Blue Water Bridge, state-owned airports and welcome centers.

Maddock said the state should not be in the business of owning bridges, rail or welcome centers. He also said Republicans are trying to avoid a gas tax increase.

“I think we have an obligation to avoid a gas tax increase, and I am willing to look at any option we have,” he told reporters.

The budget includes $1.5 billion for state trunkline construction and preservation programs, a $264.6 million increase. Of that, $212.1 million would come from the sales tax on fuel change and $45.6 million reflects the redirection of reductions made in other line items.

Another $2 billion is included for local road agencies, an increase of $438.2 million, with $330.4 million from the fuel tax change and $22.5 million from reductions elsewhere.

The House budget reduces $21.5 million in State Trunkline Fund support for various line items, including unclassified salaries ($53,600), business support ($438,700), commission audit ($226,600), economic development, enhancements ($110,600), finance, contracts and support services ($1.4 million), transportation planning ($2 million) and design and engineering services ($17.1 million).

As in other budgets, the subcommittee reduced information technology spending by 25 percent, a $6.5 million reduction.

On transit, the House budget includes $220.8 million for operating assistance to 81 local public transit agencies, which is identical to current year but $6 million less than the governor’s recommendation. It also reduces support for public transportation services by $208,500 and $10 million for a program that provides matching funds on behalf of local transit agencies to access federal transit grants.

The budget proposal reduces support by $688,400 for a program that funds transit related research, training and development, and demonstration projects and provides a $2.7 million reduction for a program that supports transit program that targets elderly and disabled populations.

The Office of Rail would see a reduction of $572,700 compared to current year. Other rail operations and infrastructure would see $80.8 million, identical to current year, for rail programs under the budget.

Finally, the budget reduces support for ferry services in the state by $200,000 and eliminates $356.7 million in one-time appropriations.

This story was published by Gongwer News Service.