COLUMBUS – Most people assumed Ohio’s marijuana revenue would work the same way legalization did.

Fast.

Sales would begin.

Money would follow.

That isn’t what happened.

After voters approved Issue 2 in November 2023, recreational marijuana sales launched in August 2024. Dispensaries opened. Consumers showed up. Taxes were collected every day.

Cities and villages waited.

Not because the money didn’t exist.

Because the system to move it didn’t.

Why Ohio’s Marijuana Tax Revenue Was Delayed

Issue 2 created a 10 percent excise tax on recreational marijuana. It directed more than a third of that revenue to a Host Community Cannabis Fund meant to benefit cities and towns that host dispensaries.

What it did not include was the mechanism.

Issue 2 created the tax.

It created the fund.

It did not create a statutory formula to distribute the money.

State agencies collected tens of millions of dollars in marijuana tax revenue but lacked legal authority to release it. The Ohio General Assembly spent more than a year debating whether — and how — it could clarify a voter-approved law without reopening it politically.

During that time, the money sat untouched.

The delay wasn’t accidental.

It was structural.

Ohio Cities Begin Receiving Marijuana Tax Revenue in 2026

Only after lawmakers approved clarifying legislation late in 2025 did the system unlock.

In January 2026, Ohio began distributing host community marijuana tax revenue for the first time, sending roughly $33 million to cities and villages statewide.

For some communities, the impact was immediate.

Seven Mile Village, a town of fewer than 1,000 residents, received about $400,000 — a meaningful infusion for a small municipal budget. Other communities are now considering how to apply the funds toward public safety, infrastructure, parks, and general operations.

Columbus Leads Ohio in Recreational Marijuana Sales and Revenue

No city benefited more than Columbus.

According to state data, Columbus recorded more recreational marijuana sales than any other Ohio city in 2025. Population size, regional draw, and the number of licensed dispensaries all contributed.

As a result, Columbus is scheduled to receive more than $4.7 million in excise tax revenue from the first host community distribution alone.

The funds have been placed into a reserve account.

Spending decisions will follow.

Ohio’s Recreational Marijuana Market Tops $1 Billion

The broader market explains the scale.

In 2025 — the first full year of adult-use marijuana sales — Ohio’s recreational cannabis market generated more than $836 million in revenue. Total sales since legalization have now exceeded $1 billion.

Prices eased.

Volume increased.

The market matured quickly.

Still, participation remains uneven.

Municipalities that banned recreational marijuana dispensaries receive no host community revenue — a choice that is now under renewed scrutiny as neighboring cities begin factoring cannabis money into their budgets.

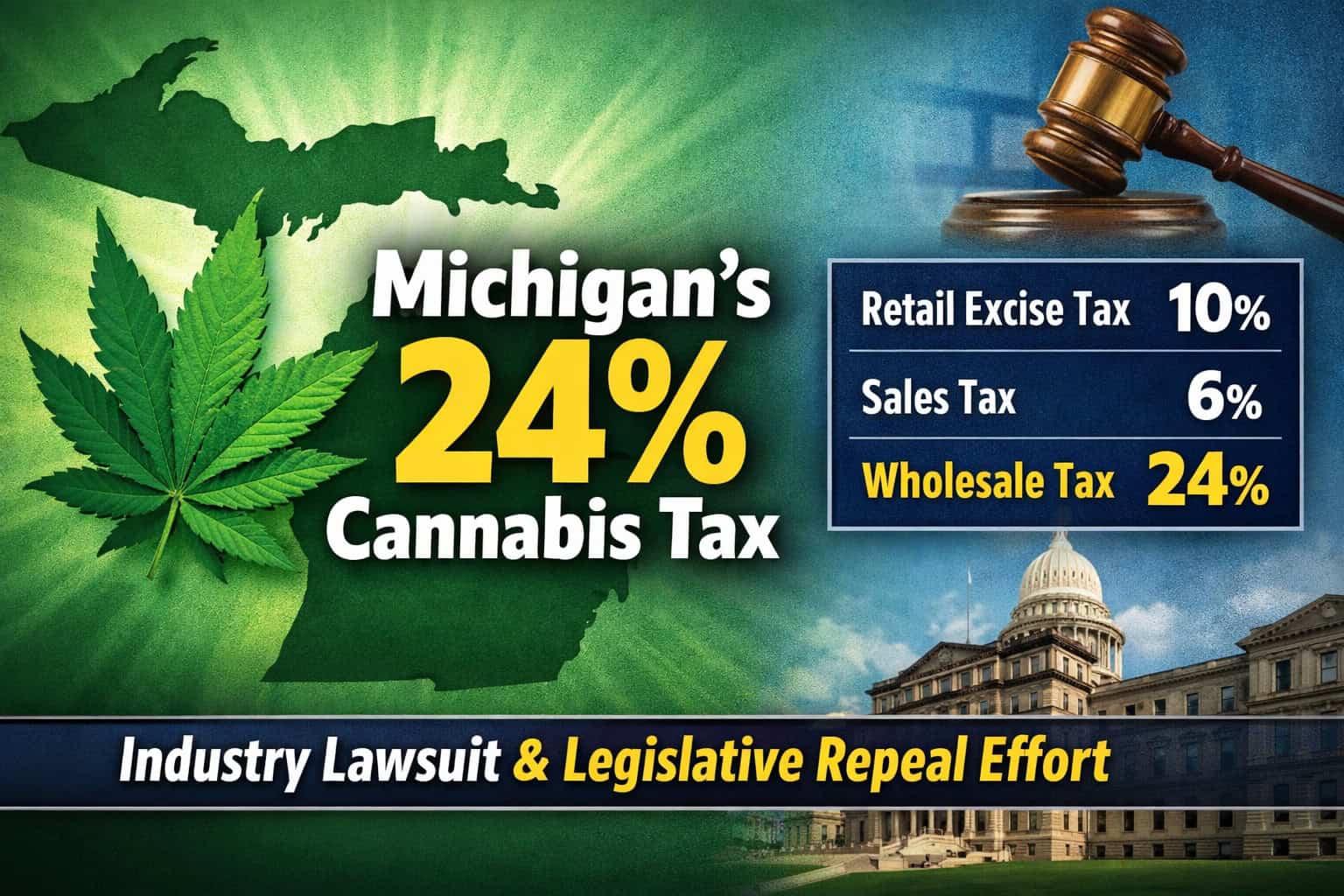

Michigan’s Marijuana Revenue Model Offers a Contrast

Michigan handled legalization differently.

When Michigan legalized recreational marijuana in 2018, lawmakers embedded the revenue-sharing formula directly into statute before the first legal sale occurred. When adult-use sales began in late 2019, municipalities already knew what they would receive and when.

According to the Michigan Department of Treasury, more than $87 million in marijuana tax revenue was distributed to local governments in 2024 alone.

There was no waiting period.

No legal ambiguity.

No frozen fund.

That predictability normalized marijuana revenue as part of municipal finance rather than treating it as an unresolved policy experiment.

What Ohio Cities Face Next

Ohio cities are receiving their marijuana tax revenue now.

The delay is already part of the record.

The revenue question has been answered.

What remains is quieter — and structural: whether the system was built to move when voters said yes, or whether it had to be finished after the fact.

Columbus Leads Ohio in Recreational Marijuana Sales and Revenue

No city benefited more than Columbus.

According to state data, Columbus recorded more recreational marijuana sales than any other Ohio city in 2025. Population size, regional draw, and the number of licensed dispensaries all contributed.

As a result, Columbus is scheduled to receive more than $4.7 million in excise tax revenue from the first host community distribution alone.

The funds have been placed into a reserve account.

Spending decisions will follow.

Ohio’s Recreational Marijuana Market Tops $1 Billion

The broader market explains the scale.

In 2025 — the first full year of adult-use marijuana sales — Ohio’s recreational cannabis market generated more than $836 million in revenue. Total sales since legalization have now exceeded $1 billion.

Prices eased.

Volume increased.

The market matured quickly.