COLUMBUS – Ohio cities are finally seeing their first marijuana tax dollars — and the early payouts show how uneven the results can be under a sales-based system.

In January 2026, Ohio began distributing adult-use cannabis tax revenue to cities and villages for the first time since voters approved legalization in November 2023. The initial disbursement highlights a sharp divide between cities with heavy dispensary traffic and those with fewer retail locations, even when population and regional demand are similar.

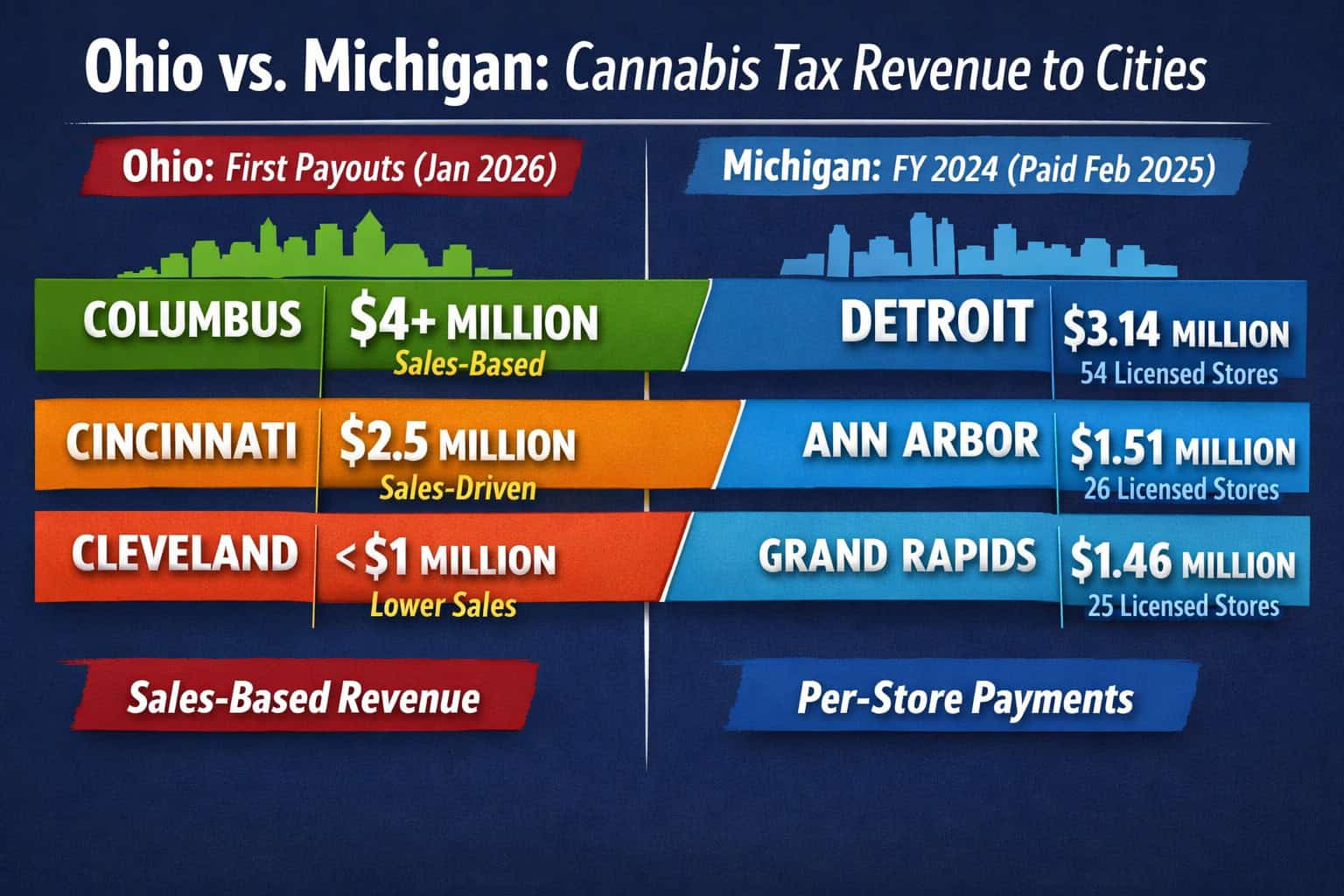

That contrast becomes clearer when Ohio’s first payouts are compared with Michigan’s most recent cannabis tax distribution, which was based on 2024 sales and paid in early 2025.

Columbus Emerges as the Clear Winner in Ohio’s First Payout

Ohio imposes a 10% excise tax on adult-use marijuana sales. Under the voter-approved law, 36% of that revenue is returned to host communities where dispensaries operate.

In the first major distribution:

-

Columbus received more than $4 million, the largest payout in the state

-

Cincinnati followed with roughly $2.5 million

-

Cleveland received less than $1 million

-

Mid-sized cities such as Akron and Dayton landed between $800,000 and $1.2 million

The reason is structural. Ohio’s system sends money where sales occur, favoring cities with more dispensaries, higher foot traffic, and regional draw. Columbus checks all three boxes.

Cleveland, by contrast, has fewer licensed adult-use retailers, limiting its share of the excise tax despite strong regional demand.

Smaller Ohio Communities See Outsized Gains

Some of the most striking results came from small municipalities with only one or two dispensaries.

Communities such as Monroe and Wintersville received close to $1 million each — rivaling or exceeding payouts to much larger Ohio cities.

For these towns, cannabis revenue has quickly become a meaningful budget line item, helping fund public safety, infrastructure, and general operations.

Michigan Cities Were Paid a Year Earlier — Under a Different Formula

While Ohio cities are just now receiving their first checks, Michigan cities already went through their most recent cannabis tax distribution nearly a year ago.

In February 2025, the Michigan Department of Treasury distributed marijuana tax revenue collected during state fiscal year 2024.

Michigan’s approach differs in one critical way:

-

Adult-use marijuana is taxed at 10% excise, plus 6% sales tax

-

Revenue flows into the Marihuana Regulation Fund

-

Local governments are paid per licensed adult-use retail store or microbusiness, not based on sales volume

For FY 2024:

-

More than $330 million was available statewide

-

Nearly $100 million went directly to local governments

-

More than 300 local entities received payments

-

Each municipality received $58,228.66 per licensed location

Ohio vs. Michigan: Cannabis Tax Revenue to Cities (Latest Payouts)

Ohio: first-ever city payouts (January 2026)

Michigan: FY 2024 revenue, paid February 2025

Columbus

$4+ MILLION ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Sales-based excise tax share

Detroit

━━━━━━━━━━━━━━━━━━━━━━ $3.14 MILLION

54 licensed retailers (fixed per-license payout)

Cincinnati

$2.5 MILLION ━━━━━━━━━━━━━━━━━━━

Sales-driven

Ann Arbor

━━━━━━━━━━━━━━━━ $1.51 MILLION

26 licensed retailers

Cleveland

< $1 MILLION ━━━━━━━━

Fewer dispensaries, lower sales capture

Grand Rapids

━━━━━━━━━━━━━━━━ $1.46 MILLION

25 licensed retailers

What the Numbers Show

The difference isn’t demand — it’s design.

-

Ohio rewards sales concentration. Big markets with heavy traffic win quickly.

-

Michigan rewards participation. Cities get paid for allowing licenses, regardless of sales volume.

Ohio’s model creates clear winners and losers. Michigan’s spreads cannabis revenue across far more communities.

What Michigan’s New 24% Wholesale Tax Does — and Doesn’t — Change

Michigan’s 24% wholesale marijuana tax, which took effect January 1, 2026, did not affect the FY 2024 distributions paid in early 2025.

That tax applies at the wholesale level and is earmarked primarily for roads and infrastructure, not direct city cannabis payouts. Local government distributions continue to be funded by the 10% retail excise tax.

Any impact from the wholesale tax — such as higher prices, slower sales, or fewer licensed retailers — would appear in future distributions, not the numbers shown here.

Why This Matters Now

Ohio’s first cannabis tax checks are already shaping how cities think about zoning, licensing, and whether allowing dispensaries is worth the tradeoffs.

Michigan’s experience shows a different path: predictable revenue, broader participation, and fewer municipal holdouts — even if individual cities don’t see massive windfalls.

As Ohio debates refinements to its cannabis tax structure and Michigan watches how the wholesale tax reshapes its market in 2026, the lesson is clear:

The money is real.

The structure decides who gets it.