LANSING — Michigan’s cannabis industry is heading into 2026 facing a new cost layer that operators say will further squeeze margins in an already oversupplied market.

Beginning Jan. 1, 2026, the state will implement a wholesale cannabis tax on transfers between growers and retailers — a structural shift that moves part of Michigan’s cannabis tax burden upstream and reshapes pricing dynamics across the supply chain.

State officials frame the tax as a way to stabilize cannabis revenue as retail prices continue to fall. Dispensaries and growers, however, warn it could accelerate consolidation, closures, and price pressure — particularly for smaller operators.

How the Wholesale Tax Works

Unlike Michigan’s existing 10% excise tax at retail, the new wholesale tax applies earlier in the transaction chain, taxing cannabis before it reaches dispensary shelves.

While the tax is assessed at the wholesale level, industry analysts say much of the cost is likely to be passed downstream — either through higher wholesale prices, reduced promotional discounts, or tighter supply terms.

“This effectively resets the baseline cost of inventory,” said one Michigan cannabis executive. “In a market built on ultra-thin margins, that matters.”

What It Means for Dispensaries

For dispensaries, the immediate impact will be compressed margins, especially for stores competing on price in saturated markets like metro Detroit, Lansing, and parts of West Michigan.

Retailers already grappling with historically low flower prices and heavy discounting may face difficult choices:

-

Absorb the added cost and accept lower profitability

-

Pass some costs to consumers and risk losing price-sensitive customers

-

Push back on suppliers for concessions, potentially straining relationships

Operators with strong private-label programs or vertically integrated supply chains are expected to fare better, while single-store and independent retailers may struggle to offset the added cost.

Pressure Builds in an Oversupplied Market

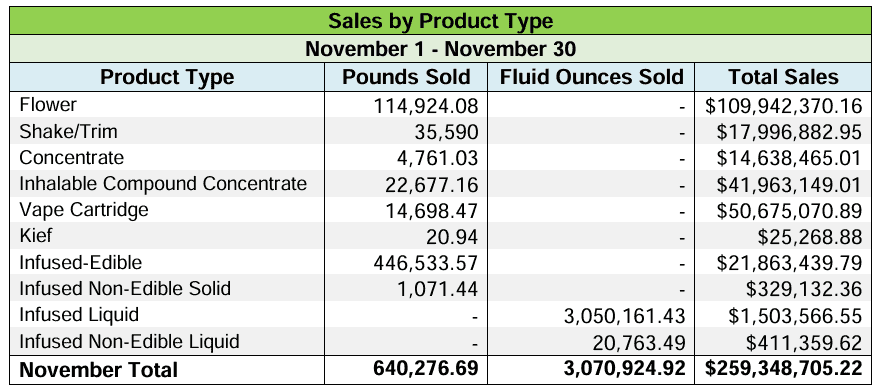

Michigan remains one of the most competitive cannabis markets in the country, posting record monthly sales even as average prices continue to slide.

The wholesale tax arrives at a moment when many operators are already operating near break-even. Analysts say the new tax could function less as a revenue generator and more as a market-shaping mechanism, accelerating consolidation among growers and retailers alike.

“We’re likely to see fewer, larger players with the balance sheets to handle another tax layer,” said a cannabis industry consultant. “The middle gets hollowed out.”

Potential Consumer Impact

In the short term, consumers may see limited price increases, as retailers fight to remain competitive. Over time, however, the wholesale tax could reduce the frequency of deep discounting and promotional pricing that has defined Michigan’s cannabis market.

That shift may help stabilize tax revenue for the state but could test consumer loyalty in a market where price competition has been fierce.

Why the State Is Making the Move

State officials argue that the wholesale tax helps address a structural imbalance: retail prices have fallen faster than cannabis tax revenues, even as enforcement, regulation, and administrative costs remain high.

By capturing revenue earlier in the supply chain, Michigan aims to smooth volatility tied to retail price swings — a move other cannabis states are also evaluating.

Industry Outlook for 2026

As Jan. 1 approaches, cannabis businesses are reworking contracts, renegotiating supplier terms, and modeling 2026 pricing scenarios.

For dispensaries, the wholesale tax won’t be a sudden shock — but it will be a stress test.

Those with scale, vertical integration, strong brands, or loyal customer bases may weather the change. Others may face difficult decisions about expansion, staffing, or even survival.

In a market defined by rapid growth and falling prices, Michigan’s wholesale cannabis tax marks a turning point — shifting the industry from a race to the bottom on price toward a tougher, more disciplined phase of competition.

Michigan Cannabis Pricing: Before vs. After Wholesale Tax

Example 1: 1/8 oz Flower

| Item | 2025 (No Wholesale Tax) | 2026 (24% Wholesale Tax) |

|---|---|---|

| Wholesale cost | $40.00 | $40.00 |

| Wholesale tax (24%) | — | $9.60 |

| Retail shelf price (before retail taxes) | $60.00 | $68.00–$72.00 |

| 10% cannabis excise tax | $6.00 | $6.80–$7.20 |

| 6% state sales tax | $3.60 | $4.08–$4.32 |

| Estimated total paid | ~$69.60 | ~$78.90–$83.50 |

| Consumer increase | — | +$9 to +$14 |

Example 2: Vape Cartridge

| Item | 2025 | 2026 |

|---|---|---|

| Wholesale cost | $60.00 | $60.00 |

| Wholesale tax (24%) | — | $14.40 |

| Retail shelf price (before retail taxes) | $80.00 | $90.00–$95.00 |

| 10% cannabis excise tax | $8.00 | $9.00–$9.50 |

| 6% state sales tax | $4.80 | $5.40–$5.70 |

| Estimated total paid | ~$92.80 | ~$104–$110 |

| Consumer increase | — | +$11 to +$17 |

Key takeaway: Even modest shelf-price increases can translate into double-digit dollar jumps per visit once layered taxes are applied.