GRAND RAPIDS — A year-long analysis of the West Michigan economy points to a clear trend heading into 2026: growth is slowing, even as the broader state economy sends mixed signals depending on region and industry.

The outlook, delivered by Paul Isely, associate dean and professor of economics at Grand Valley State University’s Seidman College of Business, was presented during the Grand Rapids Chamber’s annual meeting on Jan. 29. It reflects softer consumer spending, weakening manufacturing demand and growing policy uncertainty weighing on business investment.

“What’s our word for the year? Slow,” Isely said. “The good news is that slow means we’re still moving forward. We’ll probably speed up as the year goes along, but it’s going to be a slow year.”

Manufacturing Weakness Drives the Slowdown

One of the clearest warning signs in West Michigan is manufacturing. New orders have fallen to their lowest level since early 2024, contributing to job losses in a sector that has long anchored the region’s middle-income workforce.

Manufacturing firms in West Michigan have shed roughly 5,000 jobs over the past two years, even as industries such as finance, hospitality, construction, government, education and health care recorded modest to substantial gains. Statewide, Michigan has lost 27,000 manufacturing jobs over the same period.

“This is an amazing number because these are some of the highest-paid jobs we have for middle-income people, and it’s dropping really, really fast,” Isely said.

He pointed to regulatory uncertainty tied to the auto industry and unresolved trade policy as major contributors.

“A lot of this has to do with government uncertainty around regulations that go with cars and government uncertainty around tariffs.”

Tariffs and State Policy Pressures

Tariffs remain a growing concern for West Michigan manufacturers, many of which rely on global supply chains. Higher import costs are increasingly being absorbed by firms rather than passed along, compressing margins.

“We’ve been told that other countries are paying the tariffs, so therefore we’re collecting money that isn’t hurting our economy, but this is simply not true,” Isely said.

State-level policies are also weighing on sentiment. More than half of surveyed firms cited Michigan’s minimum wage increases, the Earned Sick Time Act and related regulatory changes as barriers to expansion.

“The government is slowing business in ways that we’ve never seen before,” Isely said.

“Businesses have always complained about regulation, but we’ve never actually seen it change how businesses invest.”

AI Investment Masks Broader Weakness

As profits tighten, companies are trimming middle management and turning to automation and artificial intelligence to preserve productivity.

“AI investment is hiding weakness everywhere else,” Isely said. “In fact, the U.S. economy this year would have been in recession if we took out AI investment.”

That dynamic is especially visible in West Michigan’s advanced manufacturing base, where productivity gains increasingly come from software and systems rather than workforce expansion.

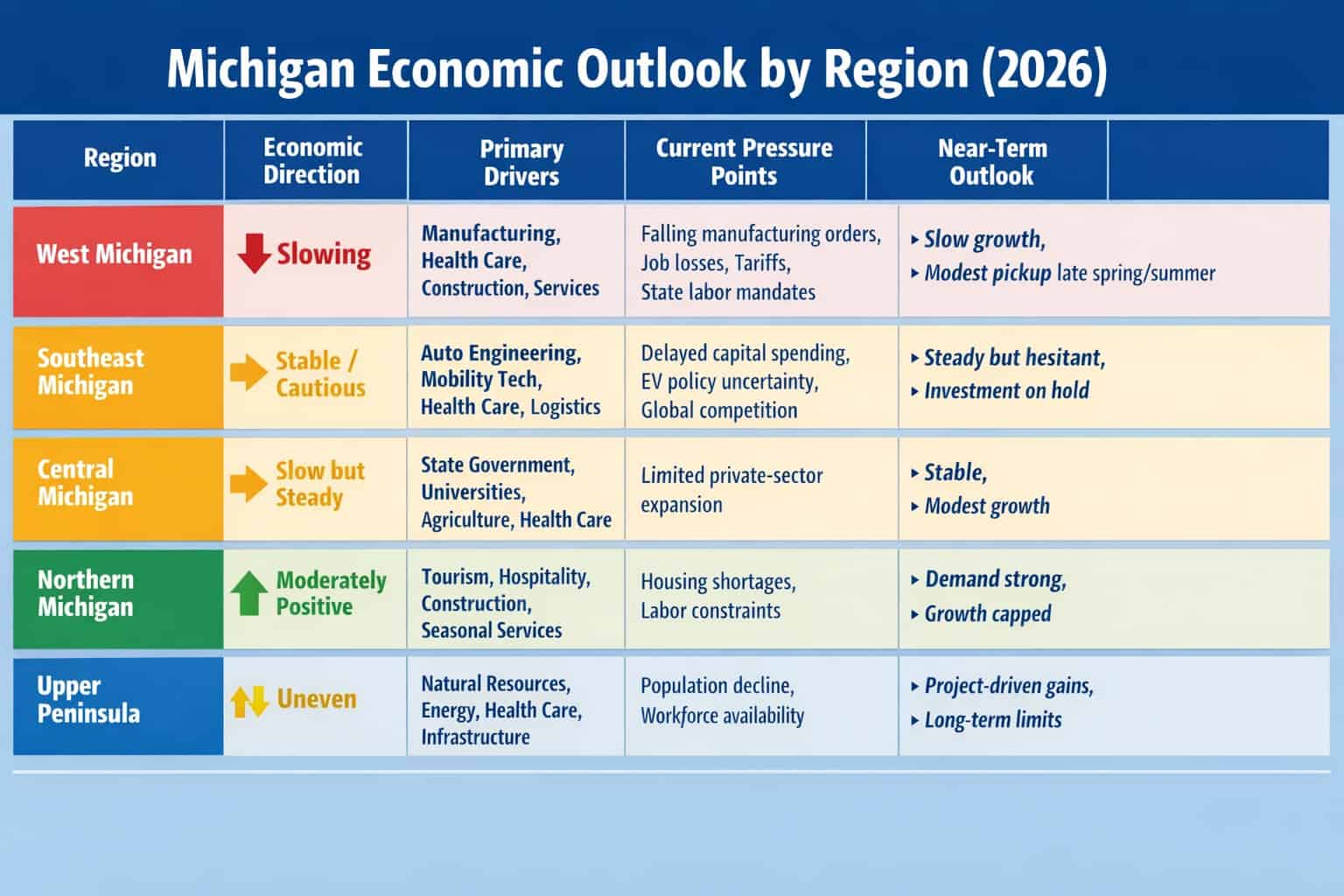

How Other Michigan Regions Compare

While West Michigan faces a broad-based slowdown, economic conditions vary sharply across the rest of the state.

Southeast Michigan: Stability With Pockets of Risk

Southeast Michigan remains Michigan’s most economically diversified region, supported by automotive engineering, health care, higher education, logistics and a growing technology sector. That diversity is helping cushion the blow from manufacturing job losses.

However, uncertainty around EV adoption timelines, shifting federal incentives and global competition continues to delay major capital investments. Automakers and suppliers are increasingly cautious, favoring incremental spending over large-scale expansions.

The result: slower but steadier growth than West Michigan, with fewer sharp contractions — and fewer rapid rebounds.

Central Michigan: Holding Steady on Institutions

Central Michigan’s economy remains anchored by state government, higher education, health care and agriculture. Those sectors tend to move slowly, but they also provide stability during economic transitions.

Public-sector employment and university-related spending have helped offset softness in private-sector manufacturing and distribution. Growth remains modest, but layoffs have been limited compared to more industrial regions.

Northern Michigan: Tourism Carries the Load

Northern Michigan continues to rely heavily on tourism, seasonal services and construction tied to second homes and short-term rentals. While interest-rate volatility has cooled some real estate activity, tourism spending has remained resilient.

That said, workforce shortages and housing constraints continue to cap growth. Employers report difficulty expanding operations even when demand exists.

Upper Peninsula: Resource-Driven, Cautiously Optimistic

The Upper Peninsula’s economy remains smaller and more volatile, shaped by mining, forestry, energy, health care and tourism. Public infrastructure spending and energy-related projects have provided intermittent boosts, but population decline and labor shortages remain structural challenges.

The region is less exposed to global manufacturing cycles than West or Southeast Michigan — but that insulation also limits upside during expansions.

A Slow Year, Not a Stall

Looking ahead, Isely expects West Michigan to show resilience and gradually improve in the spring and summer. Tax cuts included in the Trump administration’s “Big Beautiful Bill,” combined with falling interest rates, could encourage business investment in the second half of the year.

“We have some good markers that there will be some help coming in the second half of the year,” Isely said.

“Don’t expect great breakneck growth. There are some substantial downside risks, but right now those don’t seem to be coming into play.”

Across Michigan, the message is consistent but uneven: growth is slowing, not stopping — and the regions best positioned to adapt will be those with diversified economies, access to capital and the ability to navigate policy uncertainty without freezing investment.