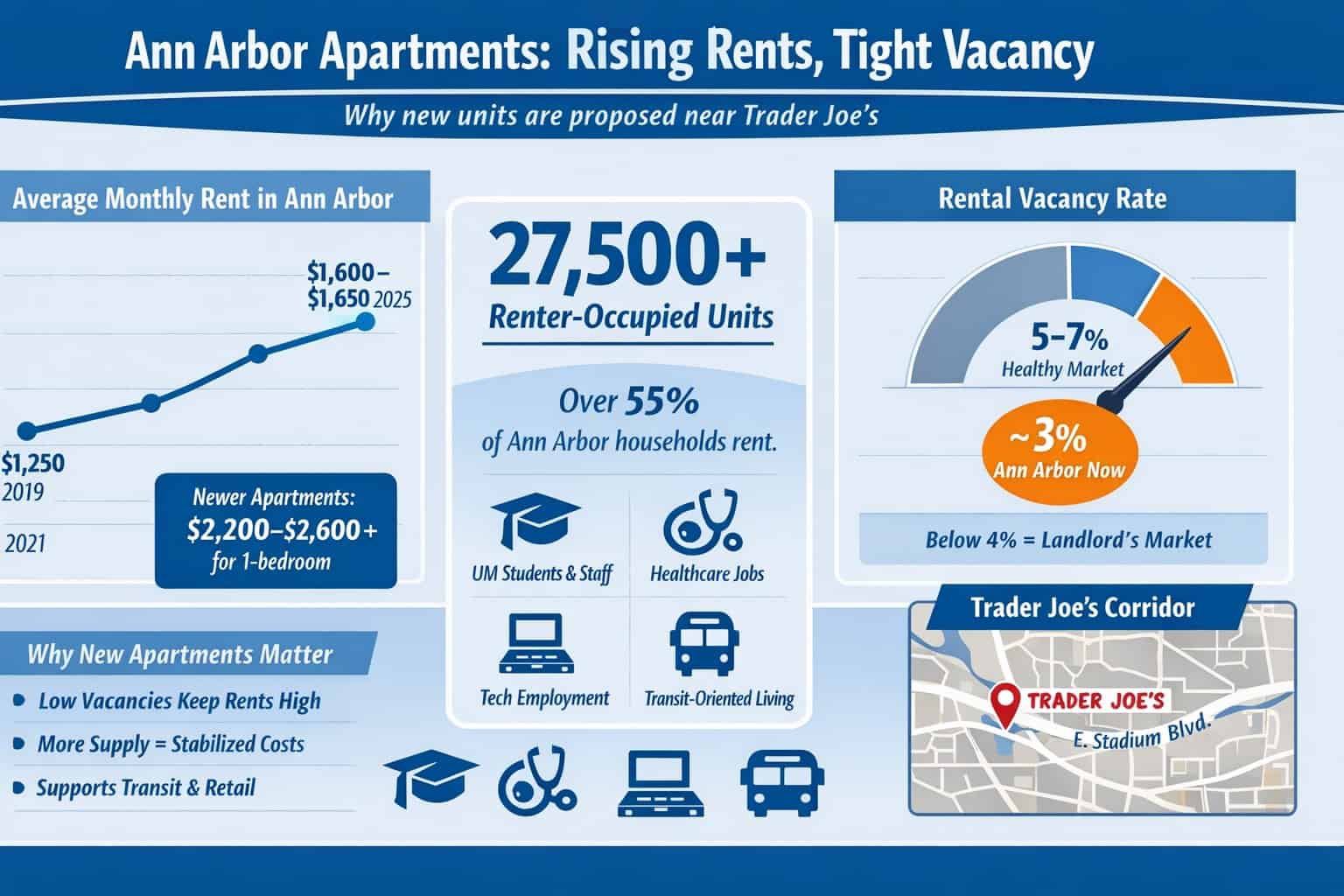

ANN ARBOR — Plans for a six-story apartment complex next to Trader Joe’s on East Stadium Boulevard are moving forward as part of a broader effort to address continued demand for rental housing in Ann Arbor. With more than 27,500 renter-occupied units in the city — about 55 % of all housing — and vacancy rates near historic lows — developers and officials argue that new supply is urgently needed.

Average Monthly Rent in Ann Arbor

-

2019: ~$1,250

-

2021: ~$1,400

-

2023: ~$1,550

2025: $1,600–$1,650 (average)

“Newer apartments often lease for $2,200–$2,600+ for one-bedroom units.”

Rental Vacancy Rate

- Healthy market: 5–7%

- Ann Arbor today: ~3%

- Occupancy rate: 94%+

- 27,500+ Renter-Occupied Units

- More than 55% of Ann Arbor households rent, driven by students, healthcare workers, and tech professionals.

Developers, City Officials Speak Out

At a recent rezoning hearing, one of the project’s developers told planners that the proposal is about creating “more housing options where people already want to live and work.” In earlier Ann Arbor discussions on rezoning and higher-density housing, a local developer stressed, “There’s no agenda here beyond building the homes people need.” — a sentiment echoed in discussions about similar high-density projects in the city.

City planners and council members have framed the project as part of a strategic shift in land use policy. “We have seen demand for rental housing push vacancy rates down and rents up, and projects like this help add units in the right places,” one planning official said at a recent public meeting on transit-oriented zoning that includes the Stadium/Washtenaw corridors.

Tight Market, Strong Demand

Ann Arbor’s rental market remains highly competitive. According to rental data, 94.4 % of apartments in the metro area are occupied, and renters often compete fiercely for available units — with landlords reporting high renewal rates and short turnaround times between leases.

Rents in the city are well above Michigan averages, reflecting constrained supply and consistent demand from students, professionals, and healthcare workers. More than 73 % of University of Michigan students live off campus, further fueling the need for quality rental housing nearby.

Existing Supply and Why New Units Matter

Ann Arbor’s existing rental stock includes thousands of apartments by count — older mid-century high-rises like University Towers with roughly 240 units, plus newer developments across the city — but even this stock fails to meet demand.

Housing market analysts estimate that the region needs about 10,000 more housing units just to keep up with current demand pressures — including both ownership and rental homes. Without significant new supply, landlords will continue to hold leverage over pricing and availability.

How the Proposed Rents Compare

While official pricing hasn’t been released for the Trader Joe’s project yet, market data show that typical rents in Ann Arbor remain relatively high:

-

Average rents citywide are around $1,600–$1,650 per month for all apartment types.

-

Newer, amenity-rich buildings in other parts of the city often command $2,200–$2,600+ for one-bedrooms, with larger units priced higher.

Given its location and likely finishes, the Stadium Boulevard development is expected to price at or above current averages — competitive with other newly built units but still offering more choices in an otherwise tight market.

What’s Next

The tract near Trader Joe’s has been part of recent transit-oriented rezoning discussions that aim to open up corridors like Washtenaw and Stadium to higher-density housing — changes that planners and developers say are crucial to addressing long-term need.

The proposal will go through additional city review, including planning commission hearings and City Council votes, before construction can begin — likely within the next one to two years if approvals proceed.