LANSING — Michigan business owners are entering 2026 facing a new and largely unavoidable cost increase: sharply higher health insurance premiums tied to the expiration of enhanced Affordable Care Act subsidies.

The federal premium tax credits — expanded during the pandemic and extended through 2025 — lowered monthly insurance costs for hundreds of thousands of Michiganders, including many small business owners, independent contractors, and employees who buy coverage on the individual marketplace. With Congress failing to extend those enhancements before the end of 2025, the financial impact is now hitting renewal notices across the state.

For Michigan’s small and mid-sized businesses, the change adds pressure at a time when employers are already contending with higher wages, rising interest rates, and tighter margins.

Why Business Owners Are Feeling It First

Unlike large corporations that negotiate group health plans, many Michigan entrepreneurs rely on ACA marketplace coverage for themselves and, in some cases, their employees. The enhanced subsidies had softened premium increases by removing income caps and limiting how much households paid as a share of income.

With those subsidies gone:

-

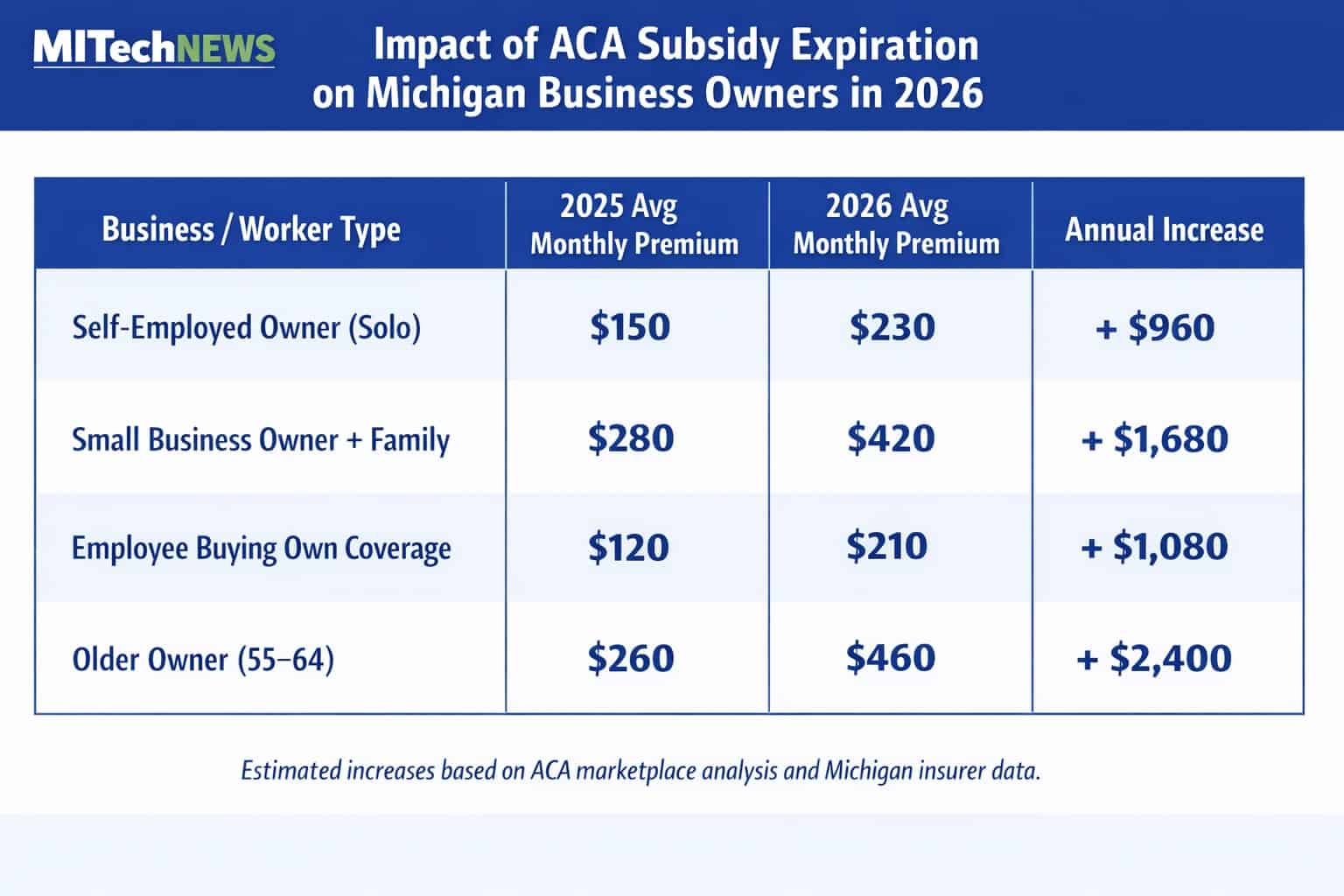

Monthly premiums for many enrollees are rising 40% to 100%, depending on income, age, and plan type

-

Self-employed owners and family-run businesses are seeing the steepest jumps

-

Employees who buy their own coverage now have less disposable income — affecting retention and wage expectations

Health policy analysts estimate more than 500,000 Michigan residents received ACA subsidies in 2025, meaning the change has broad implications for the state’s workforce and employer competitiveness.

What This Means for Hiring and Retention

For employers who don’t offer health benefits, higher individual premiums effectively act as a pay cut for workers. That can:

-

Make it harder to attract talent without raising wages

-

Increase turnover as workers seek employers with benefits

-

Push more compensation discussions toward healthcare support rather than salary alone

For employers who do offer coverage, the subsidy expiration indirectly raises pressure to absorb more healthcare costs to stay competitive — even if their own premiums didn’t spike immediately.

Michigan’s Small Business Health Credit Isn’t a Fix

While the federal Small Business Health Care Tax Credit still exists, it applies only to firms with fewer than 25 employees, relatively low average wages, and plans purchased through the SHOP marketplace. It does not replace the broader ACA subsidies that expired and does little for sole proprietors or growing firms that no longer qualify.

What Business Owners Can Do Now

Business advisors recommend several near-term strategies:

-

Review 2026 renewals carefully: Premium jumps vary widely by plan and region

-

Reevaluate benefit strategy: Partial employer contributions or HSAs may offer a recruiting edge

-

Factor healthcare into compensation planning: Benefits may now matter more than base pay for many workers

-

Monitor federal action: Lawmakers may revisit subsidies later in 2026, but no fix is guaranteed

Bottom Line

The expiration of enhanced ACA subsidies adds a new structural cost to doing business in Michigan. Whether employers offer health benefits or not, higher insurance premiums are now shaping hiring decisions, wage expectations, and workforce stability in 2026.

For small businesses already operating on thin margins, healthcare affordability has once again become a front-line economic issue — not just a policy debate in Washington.