DETROIT – Michigan’s health insurance landscape is entering 2026 under intensifying financial pressure, and businesses of all sizes — from startups to large employers — are already feeling it.

A convergence of policy changes, rising premiums and health system strain is forcing companies to rethink benefits strategies and exposing cracks in the broader health care system that could ripple through Michigan’s economy.

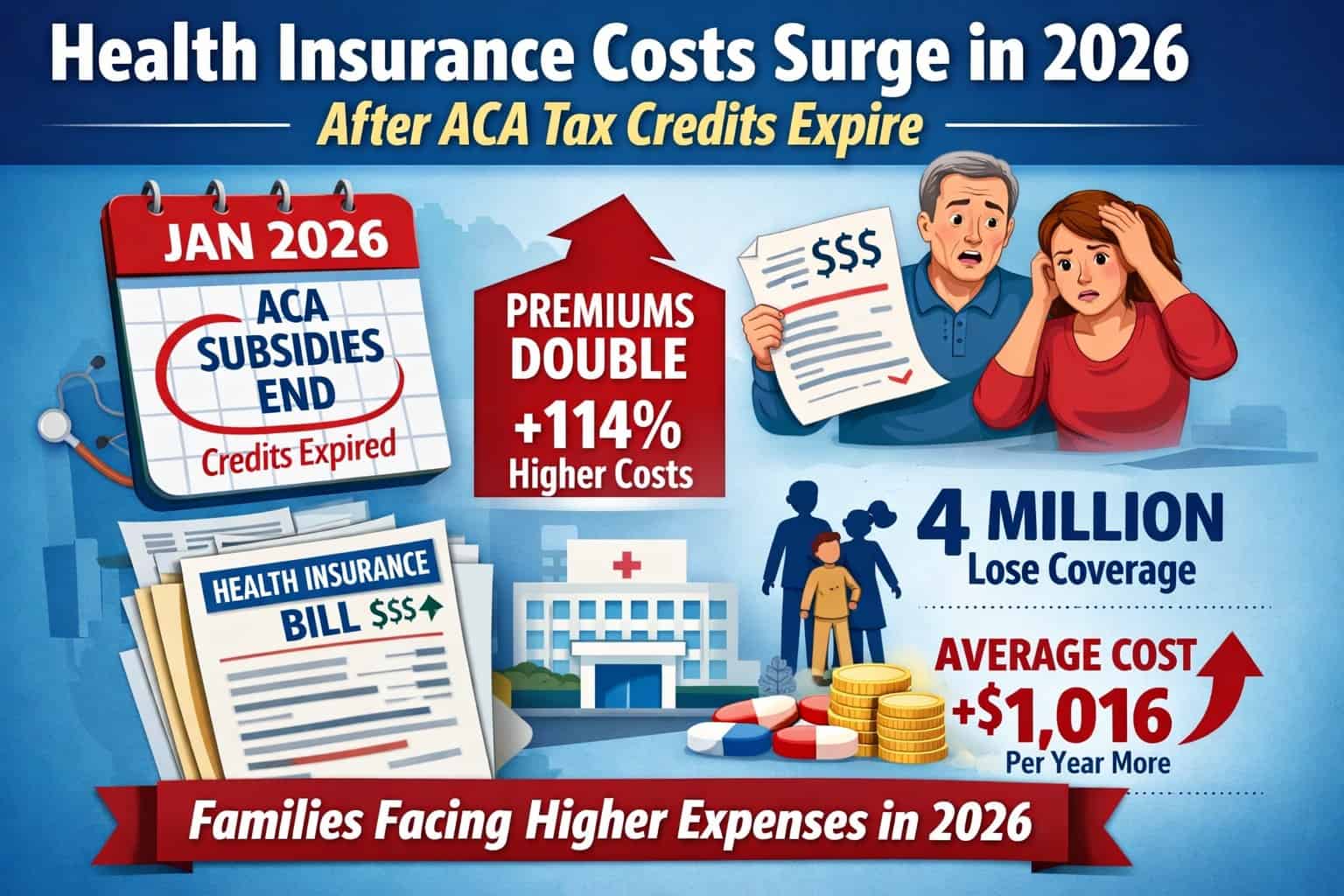

Policy Shift: The Expiration of Enhanced ACA Subsidies

One key change shaping 2026 is the expiration of enhanced Affordable Care Act (ACA) premium tax credits that helped reduce monthly insurance costs for millions of Americans during and after the pandemic. With those extra subsidies sunsetted due to the lack of congressional renewal, people who buy their own coverage face much higher out-of-pocket premiums.

-

Many middle-income households that benefitted most from expanded subsidies will now pay a far larger share of their insurance premiums.

-

Insurers responding to higher expected costs — including expensive specialty drugs such as GLP-1 medications — have sought significant rate increases for 2026 plans.

This policy shift reverberates across employer-sponsored health benefits, the individual insurance market and the hospital systems that operate at the nexus of care.

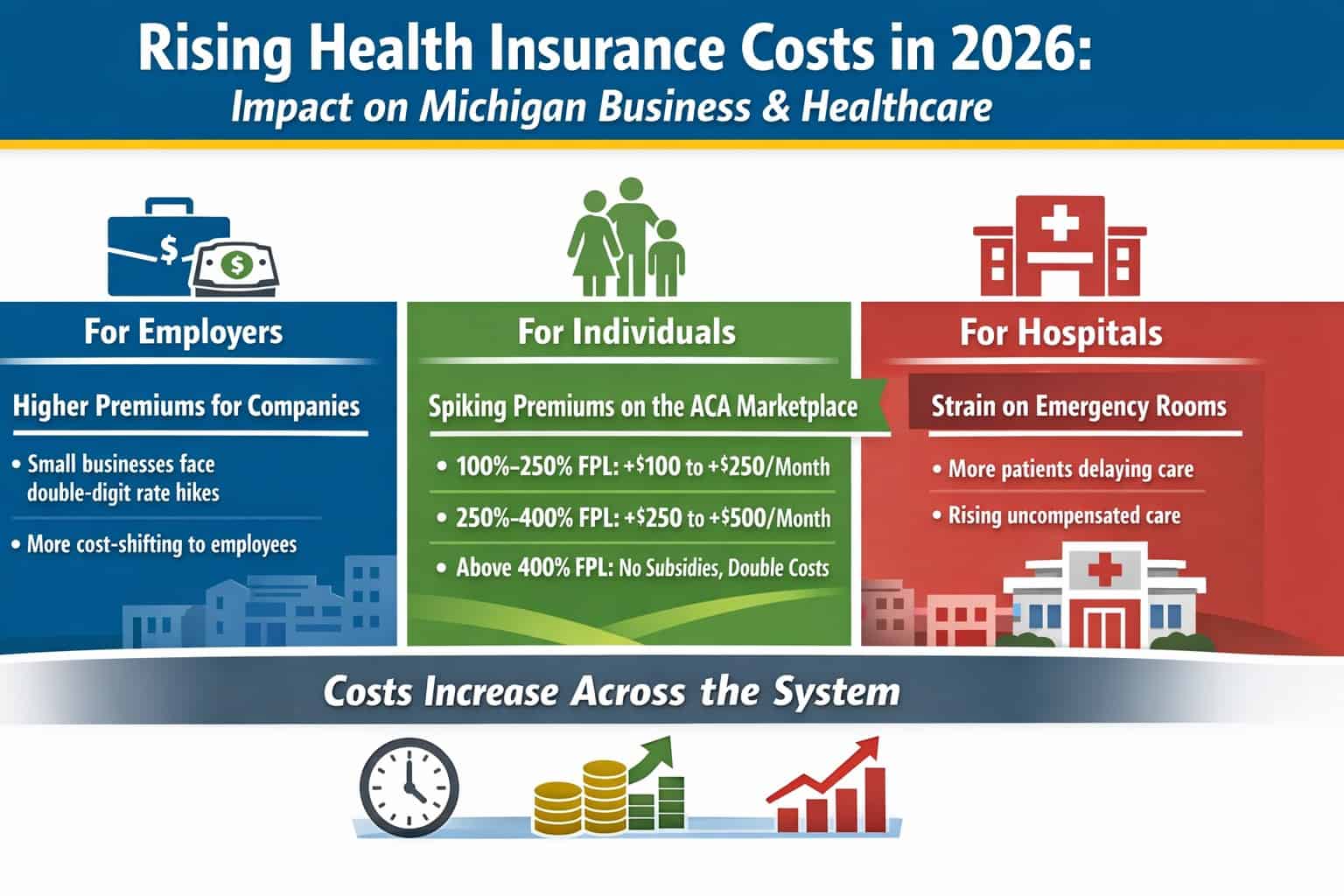

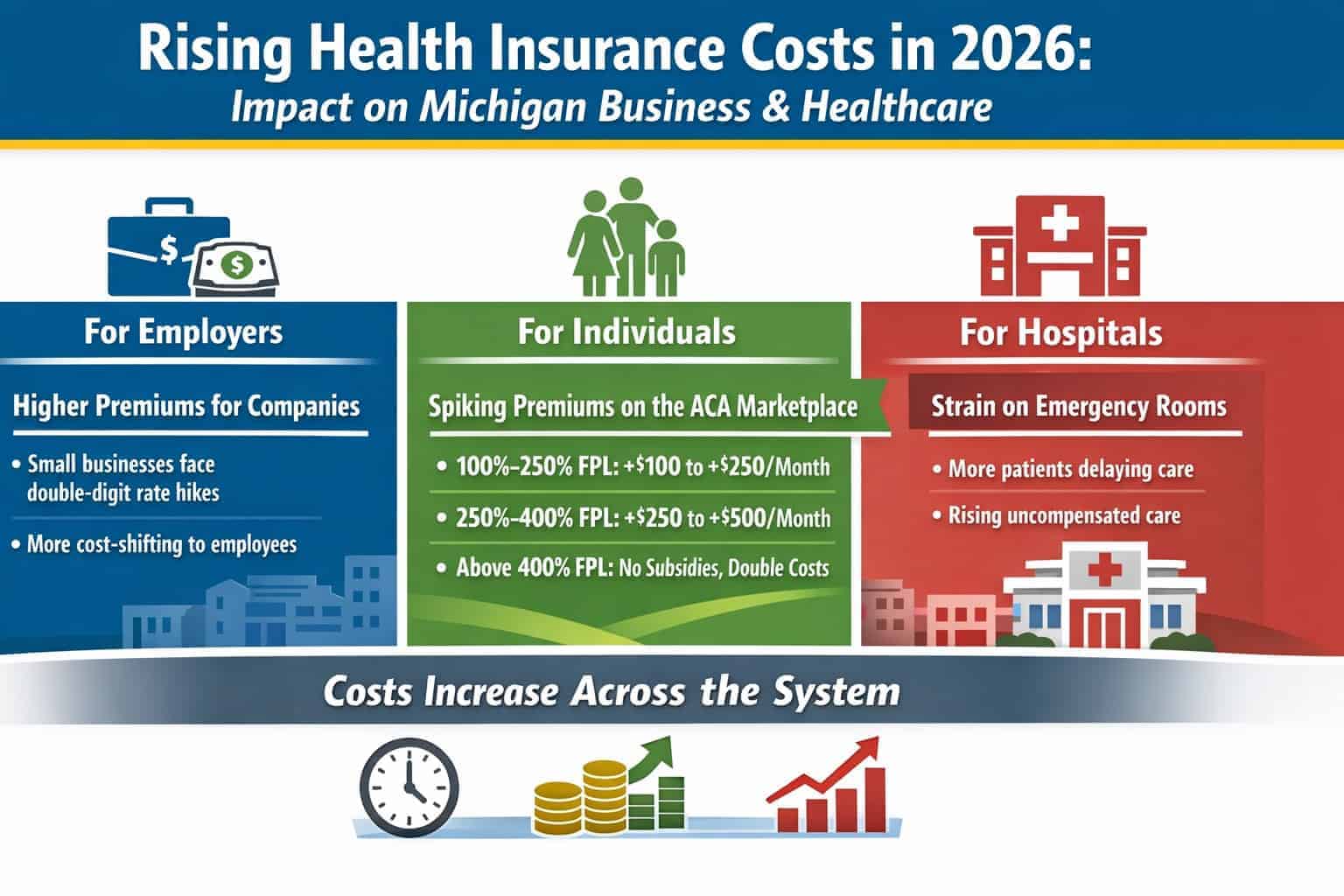

Employers: Rising Premiums and Tougher Benefits Choices

Employer Premiums Climbing

Michigan companies that provide health insurance are grappling with higher costs — particularly in the small-group market. Premiums are rising in the high single digits to low double digits, largely due to broader health care inflation and loss of federal market stability.

That means:

-

Higher employer contributions for the same benefit levels

-

Employers may shift more costs to employees to keep budgets in check

-

Some smaller firms may reconsider whether to offer coverage at all

For businesses competing for talent in sectors like technology, manufacturing, and professional services, benefit quality remains a strategic differentiator — but it’s becoming more expensive to maintain.

Individuals Buying Their Own Coverage: Premium Shocks by Income

The biggest shock is hitting individuals who buy coverage on the ACA marketplaces — a group that includes consultants, contract workers, startup founders, self-employed professionals, and employees who lose employer coverage.

Here’s a breakdown of typical premium changes for individuals based on income and plan tier in Michigan’s marketplace for 2026:

By Income Level

-

100–250% of Federal Poverty Level (FPL): ~$100–$250 more monthly

(Annual: +$1,200–$3,000) -

250–400% of FPL: ~$250–$500 more monthly

(Annual: +$3,000–$6,000) -

Above 400% of FPL: Full retail premiums with case-by-case doubling for some enrollees

(Annual increases commonly +$1,500–$9,000)

By Plan Tier

-

Bronze: Still cheapest but higher deductibles make out-of-pocket costs more burdensome

-

Silver: Most popular but now carries the largest net premium increase due to lost subsidies

-

Gold/Platinum: Premiums often become unaffordable for middle-income buyers without subsidies

The net result: many independent workers face decisions between higher premiums, skimpier coverage, or dropping coverage entirely.

Hospitals Under Strain: Emergency Care as the Safety Net

One of the less visible but highly consequential effects of dropping coverage and rising costs is how hospitals are responding — particularly in Michigan’s emergency departments.

Emergency Departments Are a Pressure Valve

According to the 2024 Michigan Certificate of Need Annual Survey, hospitals across the state collectively logged over 4.1 million total emergency department (ED) visits last year, with nearly 390,000 patients admitted through those visits.

Core facilities in Southeast Michigan — including Ascension St. John, Henry Ford Health Hospital and McLaren Macomb — each see tens of thousands of ED visits annually, underscoring how emergency care remains a massive entry point into the health system.

Emergency departments are legally required to treat all comers, regardless of insurance or ability to pay. When patients delay care because they can’t afford premiums, they often show up sicker, later and costlier to treat — pushing hospitals toward more uncompensated and undercompensated care.

Uncompensated Care and Financial Impact

State surveys show that many Michigan residents worry about affording hospital services, and a significant portion report unexpected bills — with nearly half of those bills coming from hospital care.

Hospitals already operate under thin margins and face rising labor, supply and technology costs, while payment rates from Medicare and Medicaid often lag cost growth. A national analysis highlighted by the Michigan Health & Hospital Association warns that growing costs — including workforce shortages and demand for complex services — are squeezing hospitals’ finances.

In rural areas, even more severe financial challenges loom. Federal budget cuts projected to reduce Medicaid funding could cost Michigan hospitals billions over the next decade, potentially jeopardizing services critical to local economies and public health.

Cost Shifting and the Business Bottom Line

Hospitals compensate for uncompensated care by negotiating higher reimbursement rates with commercial insurers. That practice — known as cost shifting — ultimately feeds back into:

-

Higher employer-sponsored insurance premiums

-

Rising individual market premiums

-

Greater operational strain on providers

For employers, that means health care costs remain a persistent business expense — one that squeezes budgets, complicates hiring strategies and increases financial risk.

Why This Matters to Michigan’s Business Community

Michigan’s health insurance affordability challenge isn’t just a consumer issue — it’s a labor market, financial planning and operational risk challenge for businesses.

-

Rising premiums affect total compensation costs

-

Insurance instability may influence career choices and workforce mobility

-

Hospital strain affects community health infrastructure, crucial for economic stability

In a state where health care is one of the largest employment sectors and drives substantial local spending, growing cost pressure in insurance and hospital systems can ripple across industries.

By connecting the dots between public policy, premiums and health system utilization, Michigan leaders — business and government alike — face hard decisions in 2026 about coverage affordability, health care access and the resilience of the state’s workforce.

Reporting and interviews originally published by the Detroit Free Press and expanded upon by MITechNews.