ANN ARBOR – Health care costs are climbing sharply in 2026, and Michigan households are feeling the impact from two directions at once: employers are budgeting for higher benefit costs, while many individuals buying their own insurance are seeing premiums spike after a key Affordable Care Act (ACA) subsidy program expired at the start of the year.

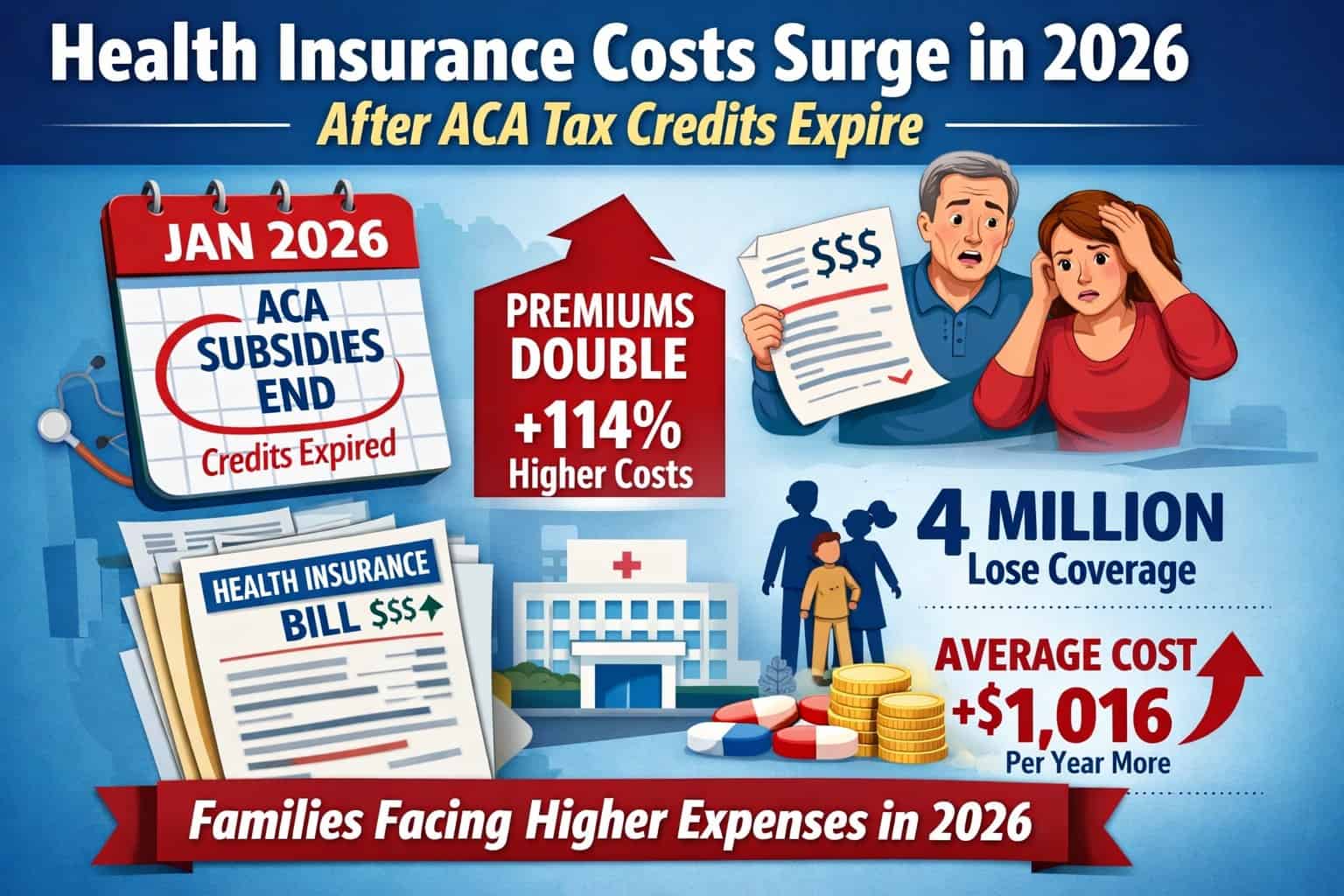

At the center of the issue is the lapse of enhanced ACA premium tax credits, a temporary expansion that had made Marketplace coverage significantly cheaper for millions of Americans. Those credits expired on Dec. 31, 2025, after Congress – where Republicans control both the House and Senate – failed to pass an extension, and the administration of Donald Trump did not secure a deal to continue them into 2026.

The result: higher monthly insurance bills for consumers — and renewed pressure on employers already bracing for rising health care expenses.

What changed on Jan. 1, 2026

The enhanced ACA tax credits were originally expanded in 2021 and later extended through 2025. They reduced monthly premiums, capped costs as a share of income, and allowed many middle-income families to qualify for help for the first time.

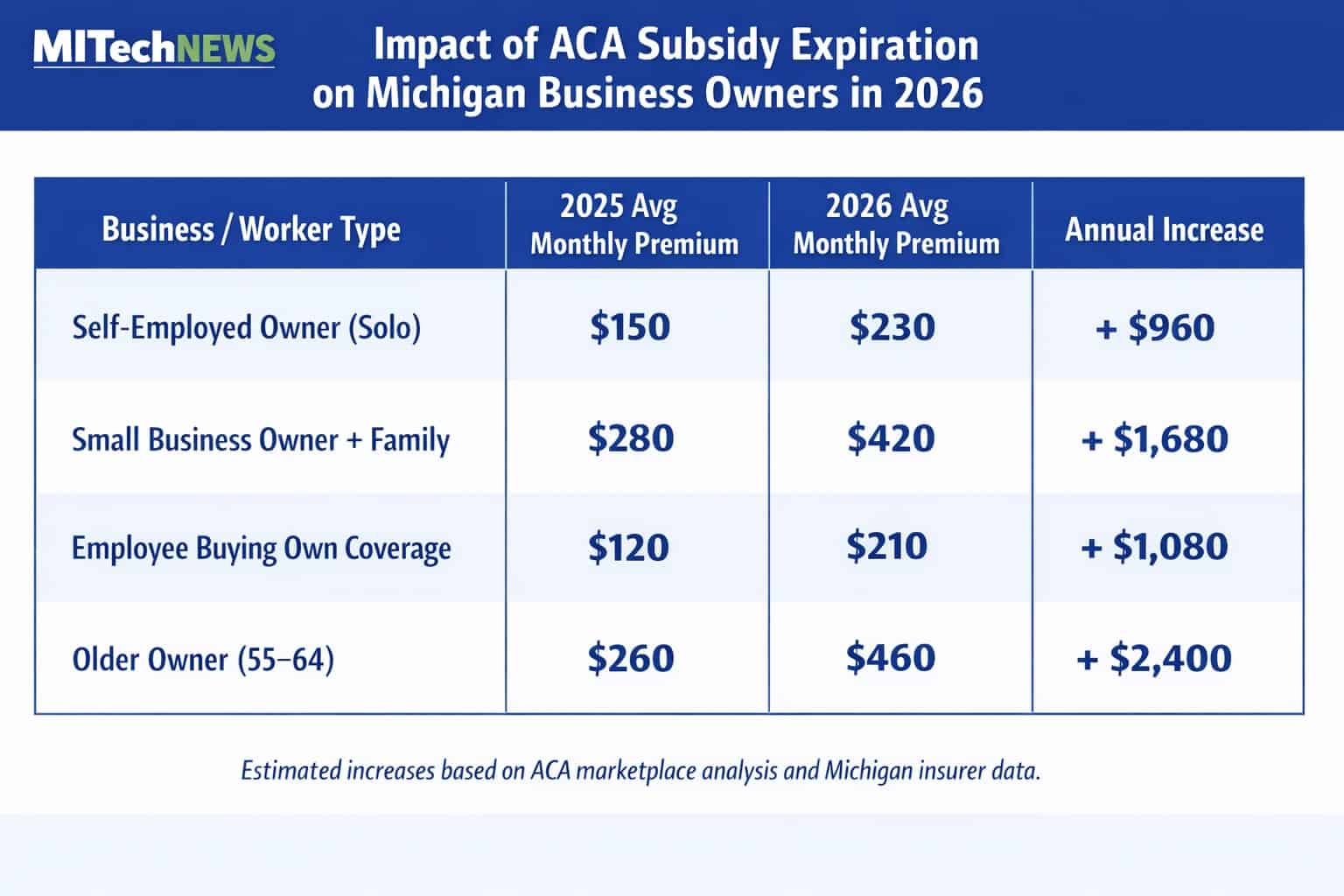

With no new legislation, the subsidy structure reverted to its pre-2021 form in 2026. That shift has immediate consequences for people who buy coverage on HealthCare.gov, including self-employed workers, gig workers, early retirees, and employees at small firms without employer-sponsored insurance.

National health policy analysts estimate that, without the enhanced credits, average premium payments for subsidized Marketplace enrollees more than doubled in 2026. For many households, that translates into hundreds — and sometimes thousands — of dollars in additional annual costs.

Michigan’s exposure

Michigan is a federally run Marketplace state, and ACA coverage plays a significant role in the state’s insurance landscape.

Before the subsidy expansion expired, hundreds of thousands of Michiganders relied on premium tax credits to make health insurance affordable. State and federal data show that Marketplace plans were often the difference between coverage and going uninsured, particularly for working families who earned too much to qualify for Medicaid but struggled to afford private insurance.

With enhanced credits gone, many Michigan consumers who previously paid little or nothing each month are now facing materially higher premiums in 2026 — forcing difficult choices about household budgets, deductibles, and, in some cases, whether to remain insured at all.

Policy analysts warn that coverage losses are likely. National projections suggest millions of Americans could drop coverage over time as higher costs push people out of the Marketplace.

Employers aren’t immune

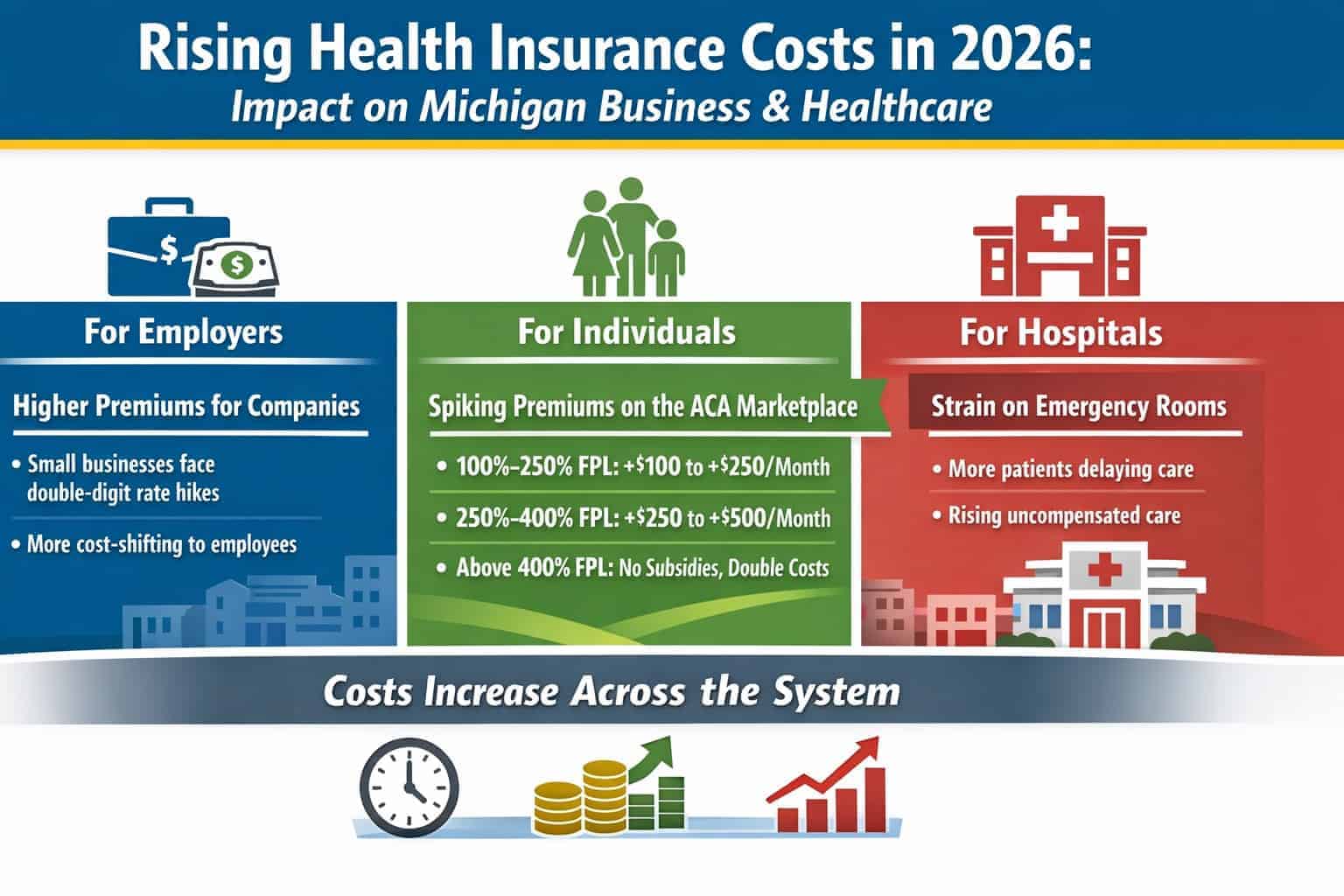

The consumer squeeze is happening just as employers are preparing for their own cost shock.

A recent survey by the Society for Human Resource Management (SHRM) found that employers expect a significant jump in health care costs in 2026, driven by higher utilization, rising drug prices, provider labor costs, and overall medical inflation.

To manage those increases, many employers are considering:

-

Higher employee premium contributions

-

Increased deductibles and copays

-

Narrower provider networks

-

Changes to plan design

For workers, that means higher costs inside employer-sponsored plans — even as family members who rely on Marketplace coverage may be paying more out of pocket as well.

A double hit for households

For many Michigan families, the 2026 health care cost story isn’t either/or — it’s both.

One spouse may see higher payroll deductions and deductibles through an employer plan, while another family member buying coverage on the Marketplace faces a steep premium increase after losing enhanced subsidies. The combined effect puts additional strain on household finances at a time when inflation in housing, utilities, and food has already tightened budgets.

Health economists describe the moment as a “misalignment” problem: policy changes and market pressures are landing on consumers simultaneously, with few short-term relief options.

The political backdrop

Efforts to extend the enhanced ACA tax credits stalled in Washington despite months of negotiations. While bipartisan talks took place, no agreement reached the finish line before the end of 2025.

The Trump administration did not push through a successful extension, leaving the expiration to take effect automatically under existing law. Any restoration of the credits now would require new congressional action — an outcome that remains uncertain in a politically divided election-year environment.

What Michigan consumers should do now

Health policy experts say the worst move is inaction. Michigan residents affected by higher premiums should:

-

Review their Marketplace plan carefully, rather than auto-renewing

-

Update income and household information, which can affect subsidy eligibility

-

Compare silver-tier plans, especially for those who may qualify for cost-sharing reductions

-

Check for special enrollment eligibility if coverage becomes unaffordable

While none of these steps fully offset the loss of enhanced tax credits, they can help consumers avoid paying more than necessary.

Health insurance costs rarely make headlines the way gas prices or grocery bills do — but for many Michigan households, 2026 may be the year those costs become impossible to ignore.

With employers tightening benefits and federal premium help shrinking, health care is emerging as one of the most consequential pocketbook issues facing workers, families, and small businesses across the state.

And unless Washington revisits the issue, the higher-cost reality of post-2025 ACA coverage may be here to stay.