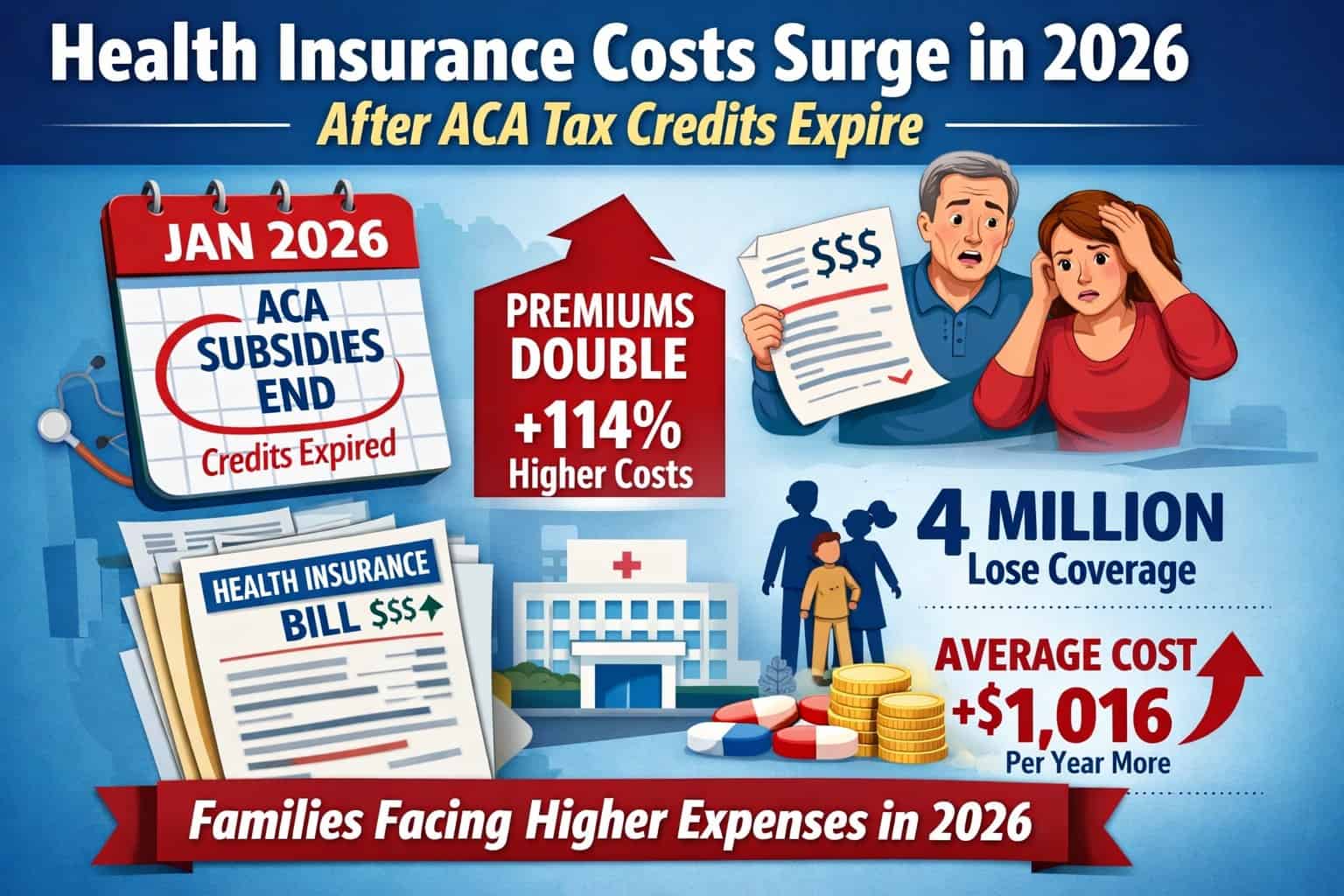

DETROIT — Health insurance costs are rising sharply for Michigan business owners, freelancers, and independent contractors in 2026 after enhanced Affordable Care Act (ACA) premium tax credits expired at the end of last year — and time is running out for those who rely on ACA marketplace plans.

Michiganders who buy coverage through the ACA marketplace have until January 15 to choose or change a health plan for 2026. After that deadline, most people will be locked into their coverage — or left uninsured — unless they qualify for a special enrollment period.

For tens of thousands of self-employed professionals across Michigan — from consultants and IT contractors to gig-economy workers and startup founders — the combination of higher premiums and a fast-approaching enrollment cutoff is already reshaping business decisions.

What Changed — And Why the Deadline Matters

The enhanced ACA tax credits, first expanded during the pandemic, capped how much households had to spend on health insurance as a share of income. Those credits expired on Dec. 31, 2025, immediately pushing 2026 premiums higher for people who buy coverage on their own.

Unlike employer-sponsored insurance, ACA users cannot wait until later in the year to adjust coverage. Missing the Jan. 15 open enrollment deadline could mean:

-

Going uninsured for all of 2026

-

Paying full, unsubsidized premiums

-

Relying on emergency care only

-

Delaying medical treatment to manage costs

That makes the current congressional stalemate especially consequential for Michigan’s independent workforce.

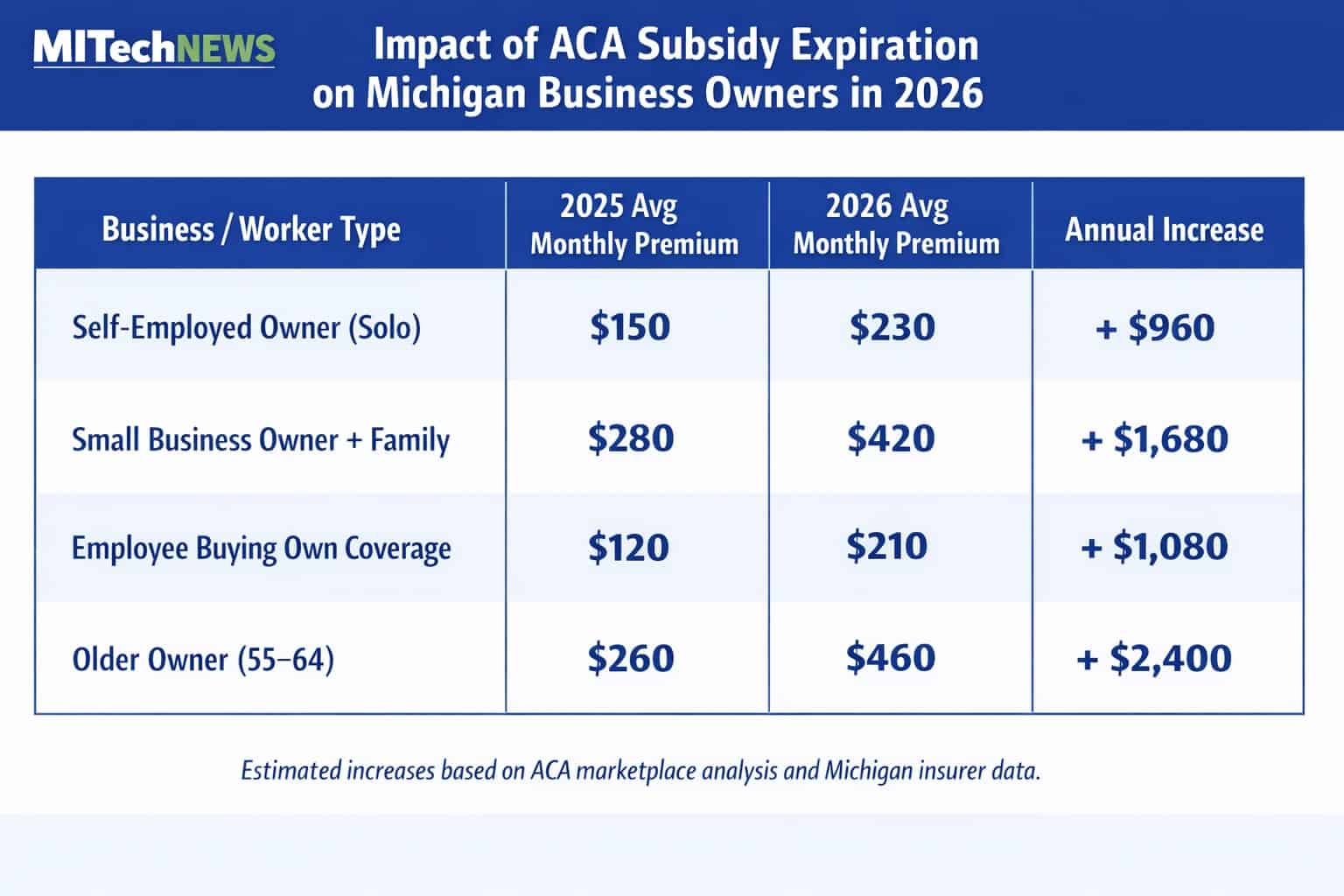

Michigan Cost Reality for the Self-Employed

Ann Arbor — Consultant or Tech Contractor

Income: ~$95,000

-

2025 premium: ~$280/month

-

2026 premium: ~$700/month

-

Added annual cost: ~$5,000

Many consultants are now deciding whether to raise client rates, downgrade coverage, or return to full-time employment with benefits.

Detroit — Small Business Owner with Family

Income: ~$65,000

-

2025 premium: ~$200/month

-

2026 premium: ~$550/month

-

Added annual cost: $4,000+

This middle-income band is among the most exposed — too high for Medicaid, too low to easily absorb full market premiums.

Grand Rapids — Solo Entrepreneur

Income: ~$45,000

-

2025 premium: ~$110/month

-

2026 premium: ~$380/month

Health navigators report this group is most likely to drop coverage entirely if Congress does not act.

Rural Michigan — Pre-Medicare Entrepreneurs

Couples in their early 60s are seeing premiums jump from ~$320/month to $1,100 or more, often forcing delayed retirement or a return to wage employment solely for benefits.

Congressional Action — But No Immediate Relief

The U.S. House has passed legislation to restore enhanced ACA subsidies for three years, but the Senate has not committed to taking up the House version.

Senate discussions instead center on a scaled-back compromise, potentially including:

-

A shorter extension

-

Income caps

-

New cost-sharing rules

Even if the Senate acts later this year, it would not reopen the Jan. 15 enrollment window, meaning many Michigan business owners must make decisions now — without knowing whether relief is coming.

Why This Is a Business Issue — Not Just a Health Issue

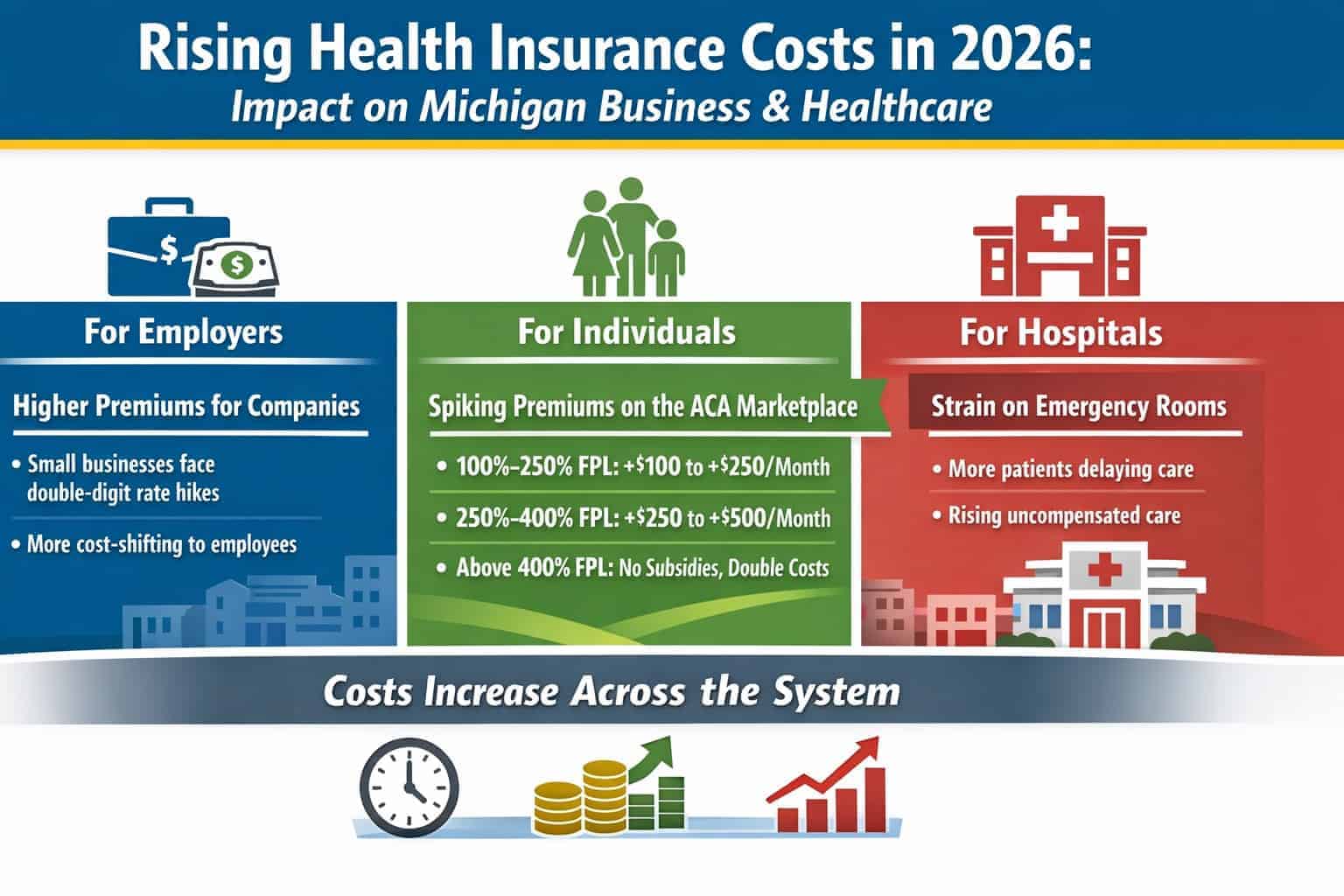

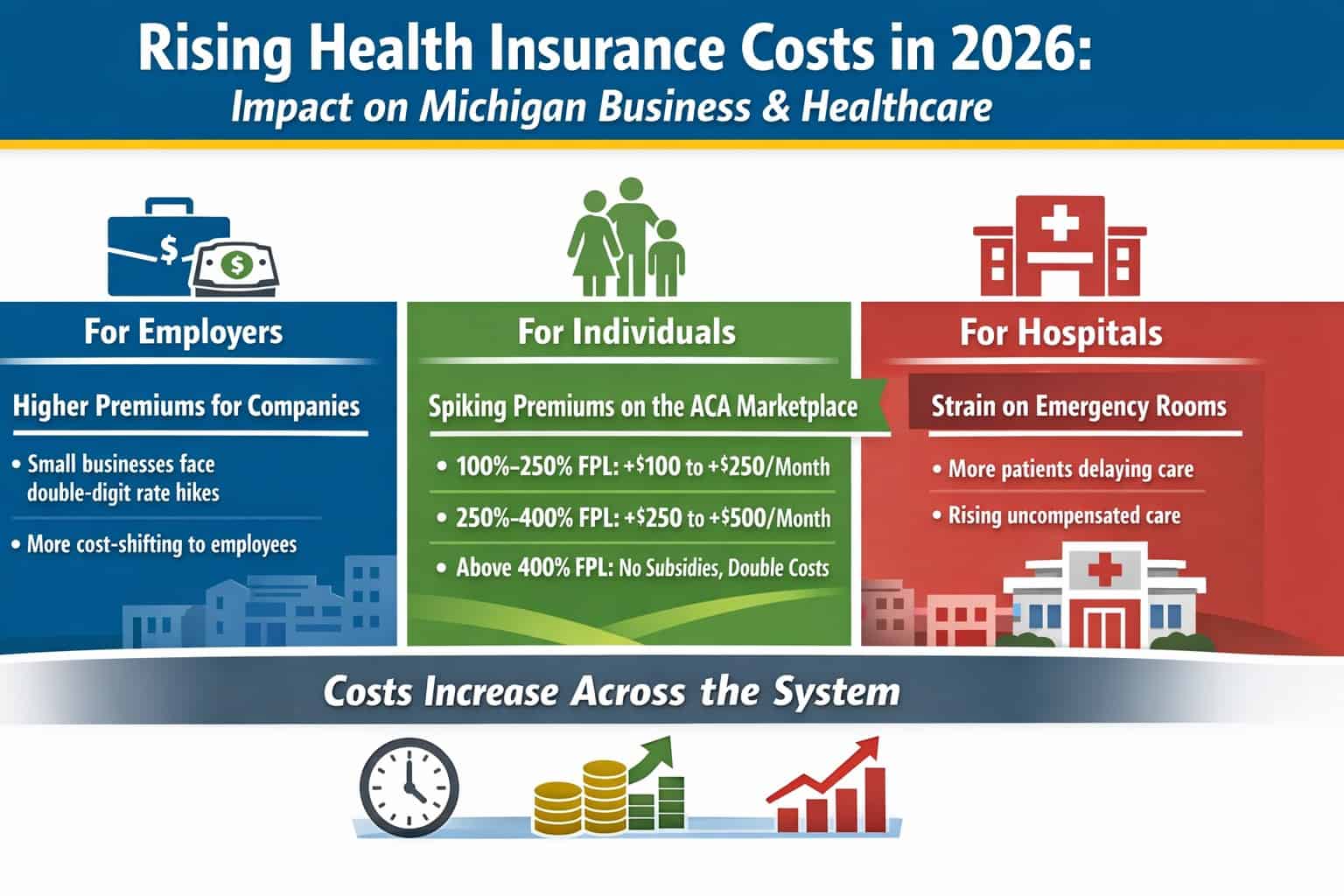

For Michigan’s economy, rising ACA premiums ripple outward:

-

Higher contractor rates to offset benefit costs

-

Reduced entrepreneurial risk-taking

-

Talent pulled back into W-2 jobs

-

More uninsured residents, raising hospital costs

-

Pressure on employers to expand benefits

Health insurance affordability has quietly become a structural constraint on Michigan’s independent workforce.

What Michigan Business Owners Should Do Now

-

Review ACA plans before Jan. 15, even if premiums look painful

-

Compare bronze vs. silver tradeoffs carefully

-

Consult navigators for subsidy eligibility changes

-

Monitor Senate action, but don’t wait on Congress to enroll

Bottom line: The ACA subsidy fight may continue in Washington, but the clock is already ticking in Michigan. For business owners and independent contractors, January 15 is the hard stop — and the decisions made now could shape both household finances and business strategy for all of 2026.