BEIJING – China continues its unstoppable rise to leadership in sustainable mobility, once they have managed to corner the market for cheap solar panels (and not perovskite ones, but silicon ones). The key now lies in the only fuel they have yet to develop, the same one that is strengthening Japan’s industry and that is making us cooperate even with Europe. Do you know what it is? They have even developed their first medium- and long-term roadmap, which shows that they are very serious.

America has EVs and FCEVs, but China seeks something “better. We have reasons for concern

The Chinese government has put together a development framework termed the Medium and Long-Term Plan for the Development of the Hydrogen Energy Industry (2021-2035) that seeks to form the basis for building a stable hydrogen economy given its long-term energy vision.

This plan also underlines the role of hydrogen energy in REDC for carbon neutrality by 2060 and place China as a prominent player in the hydrogen market. This plan will affect the FCEV industry, but the influence is especially significant for car manufacturers in China and the consequences will impact the automobile industry such as the U.S. automaker, Ford.

China wants this fuel, and it’s not kidding: It wants 100 million tons to be produced

The development plan has been released from both the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) for the hydrogen industry for the coming fifteen years. Key milestones include:

- By 2025: Build a system of hydrogen energy industrialization. This targets the production of, 100000 to 200,000 metric tons of hydrogen from renewable resources in a year, the improvement of innovation ability, and the use of 50000 FCEVs in Japan. Further, the plan entails the reduction of carbon dioxide emissions by 1-2 million metric tons per year.

- By 2030, it is necessary to strive for the proper organization of the layout of industries and the saturating use of hydrogen to contribute to reaching carbon peaking. It is expected that the hydrogen demand will reach 35 million metric tons, thereby contributing to the 5% energy mix of China.

- In 2035: Many of the hydrogen produced will come from renewable resources, since key changes must be made to these systems. The aspiration for the hydrogen industry is expected to bring an output value of about RMB 1 trillion (USD 157.44 billion) by 2025 and thousands of metric tons by 2060.

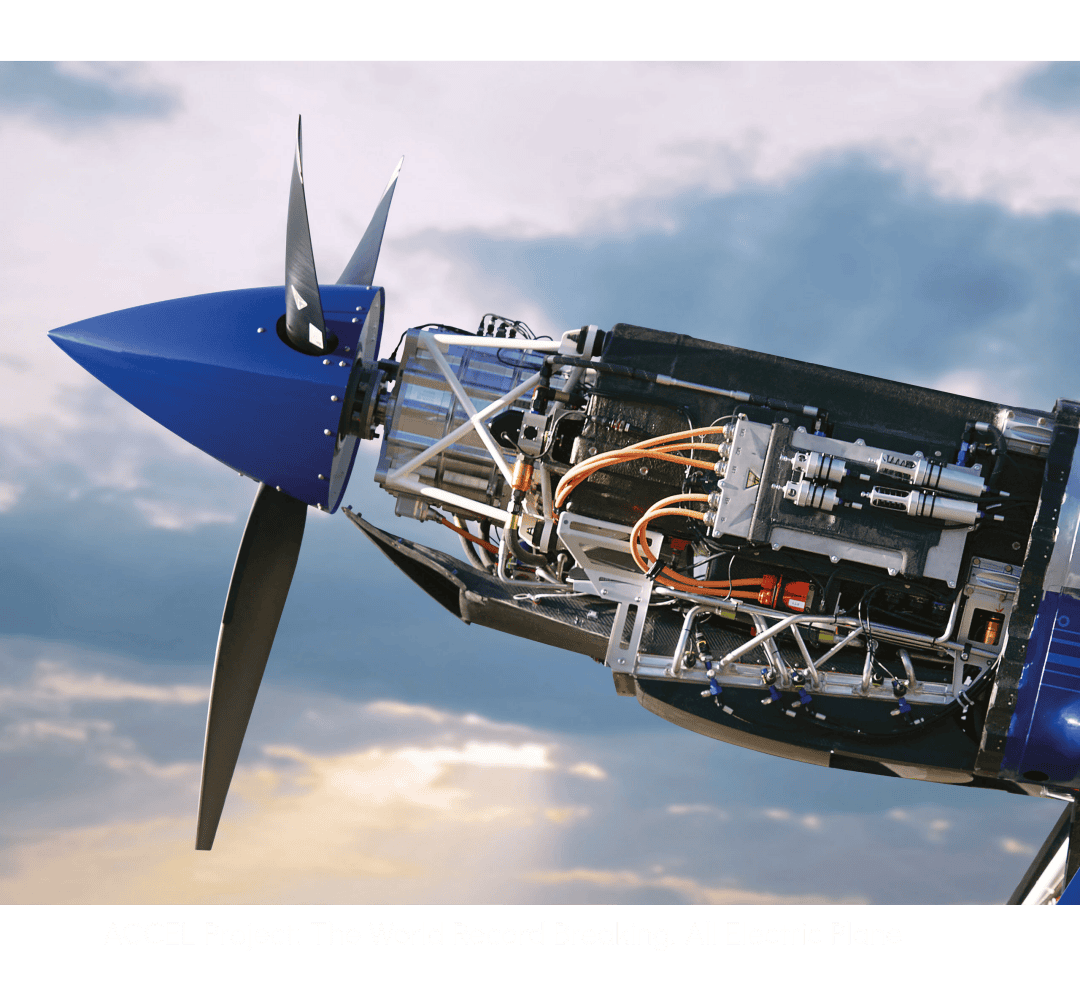

This is how China will develop the biggest hydrogen engine industry ever seen

You may imagine that there are some problems that China has yet to solve, as the plan emphasizes several critical areas for the development of the hydrogen industry:

- Production Methods: Currently, the country wishes to move from the conventional ways of generating hydrogen from fossil fuels to cleaner methods, especially renewable hydrogen. It is imperative to make this transition if the country is to successfully meet its set carbon neutrality objectives.

- Infrastructure Development: Continuation of the related hydrogen refueling station is also critical, with the aim of raising the number from 72 at middle of 2020 to 2000 in 2035. It is crucial for the support of escalating numbers of FCEVs and other hydrogen uses, services and demands.

- Technological Advancements: The plan consists of a declaration as to the willingness to increase the focus on innovation – specifically, when it comes to hydrogen technologies used for production, storage, and transportation. Laying emphasis on the development of research and development is essential for enhancing the factors of production and cost reduction.

- Industrial Applications: In addition to transportation, the plan takes a look at the diverse fields where hydrogen may be adopted; the fields include metal production, power production, and in all our homes. All in all, the diversification of the uses of hydrogen will assist in stabilizing the demand for it as well as increasing its usage.

The idea of having a Chinese hydrogen engine on the market could sound threatening to our industry, with stiff competition from Tesla and America as a whole. However, our experts have not shown excessive concern, can you imagine why? The Asian country’s industry is characterized by skimping on costs, sometimes inordinately so, and FCEVs are expensive, even more so than EVs, not to mention the cost of developing a network of refueling stations, which is almost prohibitive for the country.

This article appeared in Ecotechnicas