DETOIT – Auto insurance is a necessary evil for most drivers. We have to have it, but no one really enjoys shopping for it. Thankfully, you can now buy auto insurance online and avoid the hassle of going from agent to agent.

However, there are some advantages and pitfalls to buying auto insurance online that you should be aware of before making your purchase. In this blog post, we will discuss the pros and cons of buying auto insurance online so that you can make an informed decision about which option is best for you!

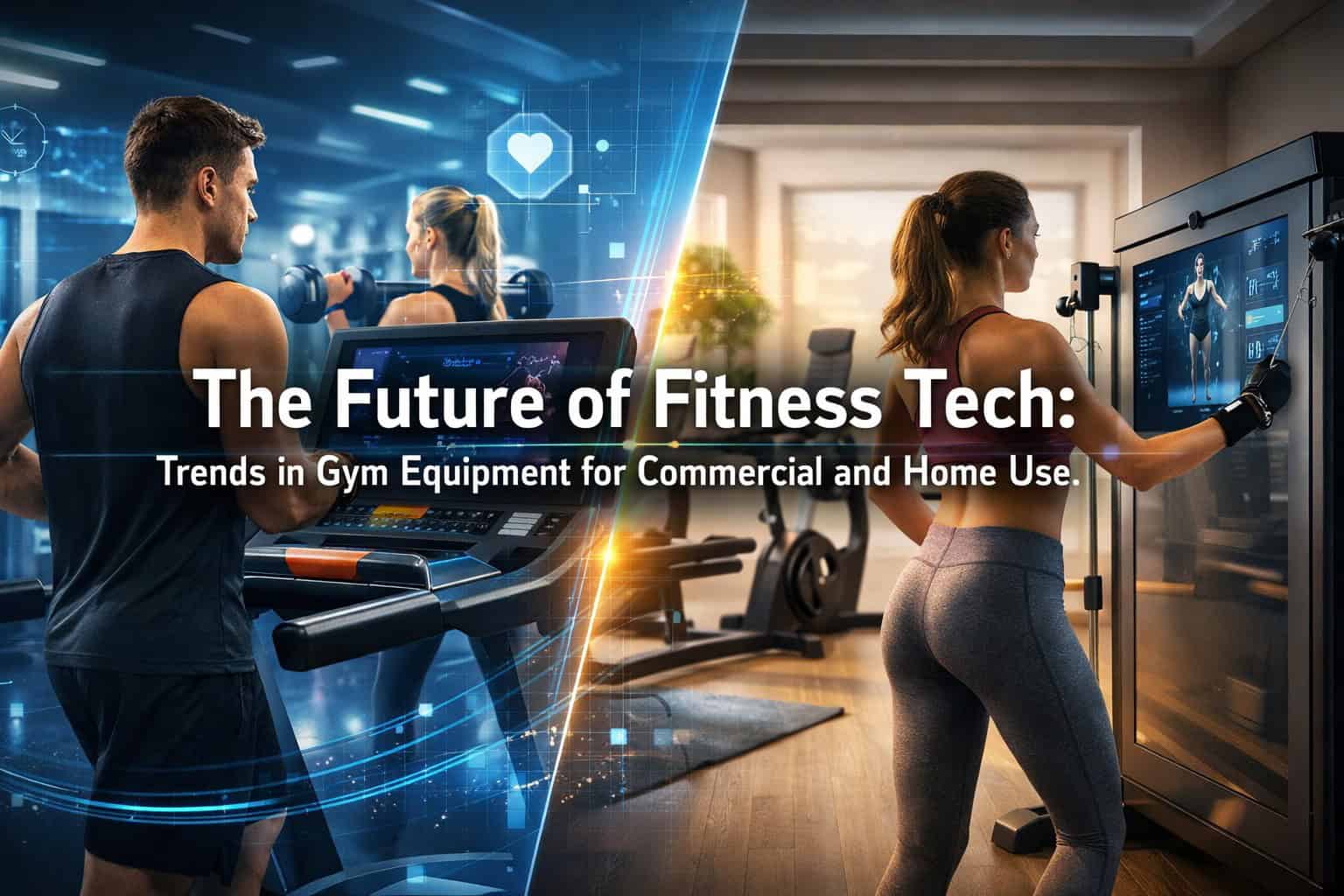

Photo by Thought Catalog on Unsplash

The Pros Of Buying Auto Insurance Online Include Convenience And Affordability

Thanks to the internet, you can now buy car insurance online. It is easier and more affordable than ever before. In the past, shoppers had to visit a variety of different websites or contact multiple insurers in order to compare rates.

Now, there are a number of websites that allow users to enter their information once and receive quotes from a variety of different companies. Not only is this process more convenient, but it also allows shoppers to compare rates side-by-side, making it easier to find the best deal. Car owners who got their vehicles from used vehicle sales can also find great choices for second-hand car insurance.

In addition, many insurers offer discounts for customers who purchase their policies online. As a result, buying auto insurance online is a great way to save time and money.

The cons of buying auto insurance online include a lack of personal interaction and the potential for scams.

When it comes to auto insurance, there are pros and cons to buying online. One of the potential drawbacks is that you may not have the opportunity for personal interaction with an insurance agent. This can be important if you have questions about your coverage or need help filing a claim.

Additionally, buying auto insurance online might make you more susceptible to scams. There are many fake websites that claim to sell insurance, but they are actually just looking to steal your personal information.

To avoid falling victim to a scam, be sure to do your research before buying auto insurance online. Only purchase from a reputable company with a strong online presence.

When shopping for auto insurance, it’s important to weigh the pros and cons of both online and offline options to find the best deal for you.

Any savvy shopper knows that the key to getting the best deal is to compare prices of used cars or trucks. And when it comes to auto insurance, there are two main ways to do this: online and offline. Each option has its own set of advantages and disadvantages, so it’s important to weigh both before making a decision.

If you opt to shop for auto insurance online, you’ll be able to compare rates from a variety of different companies all in one place. This can save you a lot of time and effort, as you won’t have to call around or meet with different agents in person.

However, it’s important to keep in mind that not all insurers list their rates on comparison sites. So if you’re set on a particular company, you may need to visit their website directly to get an accurate quote.

Shopping for auto insurance offline allows you to build rapport with an insurance agent, which can be helpful if you have questions or need assistance filing a claim. Meeting in person also gives you the opportunity to negotiate discounts or ask about bundling options that could save you money.

However, shopping offline requires more time and effort, as you’ll need to schedule appointments and meet with different agents until you find the right fit.

There’s no right or wrong way to shop for auto insurance. The best approach is the one that works best for you and your unique needs. So take some time to compare your options and make sure you’re getting the best deal possible.

The decision on where to buy auto insurance comes down to personal preference.

Ultimately, the decision on where to buy auto insurance comes down to personal preference. Some people prefer to buy from a large company like State Farm or GEICO, while others prefer a smaller, local company.

There are also a number of online companies that sell auto insurance, such as Progressive and Allstate. Each option has its own pros and cons, so it’s important to do some research before making a decision. For example, larger companies typically have more resources and can offer more discounts, but they may also be more impersonal.

Smaller companies may be more expensive, but they often provide better customer service. Ultimately, the best option is the one that meets your specific needs and budget.

When it comes to buying auto insurance, there are a number of factors to consider. The most important thing is to compare rates and coverage options from different companies before making a decision.

There are both advantages and disadvantages to buying auto insurance online or offline, so it’s important to weigh all of your options before making a final decision. Ultimately, the best option is the one that meets your specific needs and budget.

This story was written by Rory Dixon