ANN ARBOR – As 2025 winds down, the U.S. auto market carries over a mix of record pricing, shifting incentives, and inventory dynamics that will shape car buying in 2026. Here’s what buyers and local Michigan tech commuters need to know:

1. New-Car Pricing Is Staying High — But Might Stabilize

• Average new-vehicle prices have recently topped $50,000 nationwide — a historical high driven by demand for larger SUVs, trucks, and tech-rich models.

• After years of steep increases, pricing growth is expected to moderate in 2026, with analysts seeing mild rises instead of runaway inflation. Some forecasts project a 2–4% increase in new car prices overall next year.

What this means: Buyers shouldn’t expect steep discounts across the board in 2026 — but the pace of price growth could calm compared with the turmoil of recent years.

2. Used Cars: Normalizing but Still Strong

• Used-car values have started to ease back from their pandemic-era highs, with some wholesale and retail prices dipping as supply grows and dealer trade-ins rise.

• Despite softening, used vehicles remain significantly more expensive than they were pre-pandemic, maintaining strong pricing power in many segments.

What this means: If you’re considering a certified pre-owned or lightly used vehicle in Southeast Michigan, you may find more negotiation room — but dramatic price drops aren’t guaranteed.

3. Interest Rates and Loan Terms Still Matter

• With interest rates modestly lower than earlier in 2025, monthly payments may be easier to manage for qualified buyers — yet buyer credit quality remains a big factor in securing favorable terms.

• Dealers and financial institutions increasingly push longer loan terms (e.g., 72–84 months) to keep monthly payments down — but that means paying more over time.

What this means for tech professionals: Budget your purchase with total cost in mind — lower monthly payments can mask higher lifetime costs.

4. EV Pricing Is a Wildcard

• Electric vehicles (EVs) may buck the broader trend: some EV prices are expected to soften in 2026 as federal tax incentives fade and automakers adjust strategy. Other models may see discounts or repositioning to spur adoption.

• EVs still carry tech premiums on average, but competition and battery cost efficiencies could make them more attractive later in the year.

Good news for Michigan: Local buyers watching EV trends might find more accessible pricing, especially on well-spec’d models.

5. Industry Forces Still in Play

Several macro forces are driving price expectations:

-

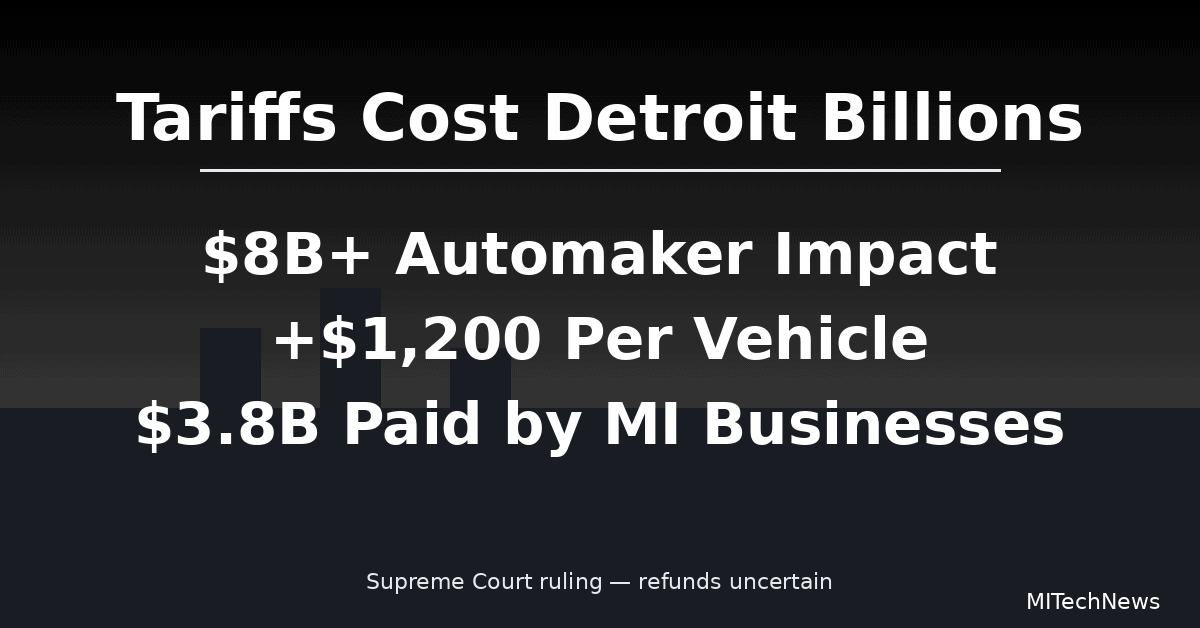

Tariffs and supply chain costs have pressured automakers’ margins and may push prices modestly higher in some segments next year.

-

Inventory transitions with 2026 model year vehicles arriving now keep dealer lots full, which can temper pricing strength.

-

Consumer confidence and economic conditions will influence how aggressively buyers commit to purchases.

Bottom Line for 2026 Car Shoppers

-

New-car prices likely won’t plunge — but they may level off or rise only modestly.

-

Used cars are becoming more affordable compared to the peak — though values still outpace early-2020s norms.

-

EVs and tech-heavy models could see selective drops or competitive pricing in 2026.

-

Smart timing and negotiation remain key — end of month/quarter and model changeover periods can yield better deals.

For Michigan’s tech workforce — where commuting reliability and resale value matter — understanding these trends now can help you plan the best time to buy, trade, or lease in the coming year.