LANSING — A new federal tax deduction signed into law by President Donald Trump could shave a few hundred dollars off the tax bills of some Michigan residents who finance new vehicles, but auto industry analysts and financial advisers say the bigger money question for most buyers still comes down to how they pay for a car.

The new provision, included in a broad tax package approved by Congress earlier this year, allows taxpayers to deduct up to $10,000 in interest paid on auto loans for new vehicles purchased beginning in 2025. Unlike many deductions, it can be claimed even by filers who take the standard deduction.

The deduction applies through tax year 2028 and is limited to new vehicles assembled in the United States, a key factor in Michigan, where domestic production remains central to the economy. Income limits apply, with the full deduction available to single filers earning under roughly $100,000 and married couples earning under $200,000.

Still, for many Michigan households, the deduction will translate into modest savings, often a few hundred dollars a year, depending on loan size, interest rate and tax bracket. That reality has pushed buyers to focus less on the tax break itself and more on the financing strategy that best fits their budget.

Ways to Finance a Vehicle: Options, Costs, and Tradeoffs

| Financing Method | How It Works | Typical Monthly Cost | Tax Deduction Eligible? | Best For | Key Risks / Downsides |

|---|---|---|---|---|---|

| Traditional Auto Loan (Bank/Credit Union) | Loan secured by the vehicle, usually 48–72 months | Medium | ✅ Yes (new, U.S.-assembled vehicles only) | Buyers with good credit seeking ownership | Higher interest if credit is weak |

| Dealer Financing | Loan arranged through dealership or automaker finance arm | Medium | ✅ Yes (if qualifying vehicle) | Convenience, promotional offers | May trade low rate for fewer rebates |

| Manufacturer Incentive Financing (0% APR) | Automaker subsidizes interest | Low | ⚠️ Technically yes, but little/no benefit | Buyers who qualify for top-tier credit | Often excludes cash rebates |

| Leasing | Pay for depreciation, not ownership | Low | ❌ No | Drivers who want lower payments and frequent upgrades | Mileage limits, no ownership |

| Cash Purchase | Pay full price upfront | None | ❌ No | Buyers avoiding debt | Ties up savings; no leverage |

| Home Equity Loan | Fixed loan backed by home equity | Medium | ❌ No (non-housing use) | Homeowners with strong equity | Home at risk if payments fail |

| HELOC (Home Equity Line of Credit) | Revolving credit secured by home | Variable | ❌ No | Flexible timing purchases | Variable rates; housing risk |

| Personal Loan (Unsecured) | Fixed loan, no collateral | High | ❌ No | Private sales, older vehicles | Higher interest rates |

| Buy Here, Pay Here Dealer | In-house dealer financing | Very High | ❌ No | Buyers with poor credit | Extremely high interest, repossession risk |

| Employer Vehicle Program | Company subsidy or loan | Low | ❌ No | Executives, sales staff | Limited availability |

| Family Loan | Private agreement between individuals | Low–Variable | ❌ No | Informal financing | Legal and relationship risks |

| EV-Specific Utility or OEM Programs | Special financing for EVs | Low | ⚠️ Loan may qualify, incentives separate | EV buyers | Program availability varies |

Traditional Auto Loans Remain the Default

For most Michigan drivers, the standard auto loan — offered by banks, credit unions and dealership finance arms — remains the most common option. These loans typically run 48 to 72 months, with interest rates that vary widely based on credit scores and market conditions.

Credit unions, particularly community-based institutions across Michigan, often offer lower rates than national banks or dealer financing, especially for borrowers with strong credit. For buyers who qualify for the new tax deduction, interest paid on these loans may now reduce taxable income — but experts note the deduction alone rarely offsets higher interest rates.

“In practice, the better move is still to shop for the lowest rate possible,” said one Michigan-based financial adviser. “The tax break helps, but it shouldn’t drive the decision.”

Dealer Incentives and Manufacturer Financing

Automakers frequently offer subsidized financing, including zero-percent or low-interest loans, especially during promotional periods or when inventory builds up. In Michigan, where many residents have access to employee, retiree or supplier pricing programs, these deals can significantly reduce borrowing costs.

However, buyers should weigh whether taking a low-interest loan means giving up other incentives, such as cash rebates. In some cases, choosing a rebate and financing through a bank or credit union can cost less overall than accepting the manufacturer’s financing.

From a tax perspective, loans with little or no interest generate minimal deductions, making the new tax break largely irrelevant for those buyers.

Leasing: Lower Payments, No Deduction

Leasing remains popular among Michigan drivers who prefer lower monthly payments and the ability to drive a new vehicle every few years. But leases do not qualify for the new federal deduction, because lease payments are not considered loan interest.

That exclusion is significant in metro Detroit and Ann Arbor, where leasing rates have historically been high. For many consumers, the flexibility of leasing still outweighs the tax advantage of ownership, especially for drivers who log fewer miles or want predictable costs.

“Leasing is about cash flow and convenience,” said a Southeast Michigan auto dealer. “The tax deduction doesn’t really change that equation.”

Paying Cash: No Interest, No Tax Benefit

Some Michigan buyers, particularly older residents or those downsizing from larger vehicles, choose to pay cash. While this avoids interest entirely, it also means forfeiting any benefit from the new deduction.

Financial planners often caution against draining savings to buy a depreciating asset outright, especially when those funds could earn returns elsewhere. Still, in a high-interest environment, paying cash can make sense for buyers who value simplicity and debt-free ownership.

Home Equity Loans and Lines of Credit

Another option some Michigan homeowners consider is using a home equity loan or home equity line of credit (HELOC) to finance a vehicle purchase. These loans often carry lower interest rates than auto loans, particularly for borrowers with strong credit and significant home equity.

However, the risks are higher. The home becomes collateral, and failure to repay could jeopardize housing stability. In addition, interest on home equity loans is generally deductible only when the funds are used for home improvements, not for vehicle purchases, limiting tax advantages.

Personal Loans: Flexible but Costly

Unsecured personal loans offer flexibility and quick approval but usually come with higher interest rates than auto loans. These loans may appeal to buyers purchasing older vehicles or from private sellers, but interest paid on personal loans does not qualify for the new auto loan deduction.

In Michigan’s used-car market — still tight after years of supply disruptions — personal loans remain a niche option rather than a mainstream choice.

Employer and Specialty Programs

Some Michigan employers, especially in the automotive and technology sectors, offer vehicle purchase assistance programs, including low-interest loans or car allowances. Veterans may also qualify for special financing through military-affiliated credit unions.

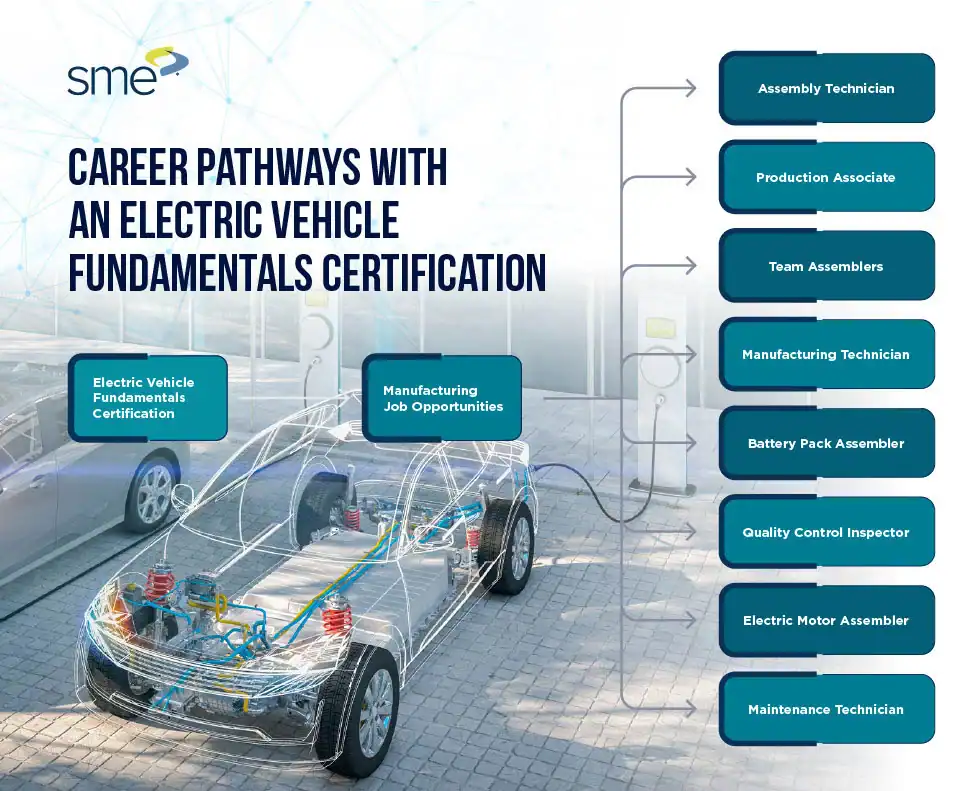

Electric vehicle buyers may find additional incentives through utility programs or local clean-energy initiatives, though these benefits typically apply at the state or local level rather than through federal tax deductions.

The Bottom Line for Michigan Buyers

While the new auto loan interest deduction adds a new wrinkle to vehicle financing, experts agree it is not a deciding factor for most Michigan consumers. The real savings still come from choosing the right financing structure, minimizing interest costs and aligning payments with household budgets.

For Michigan’s auto-centric economy, the deduction may offer a small boost to new-vehicle sales, particularly for U.S.-assembled models. But for buyers, the smartest move remains unchanged: compare financing options carefully, read the fine print and don’t let a tax break overshadow the true cost of ownership.