DEARBORN — Ford Motor Co. and South Korean battery manufacturer SK On are unwinding one of the most ambitious electric-vehicle bets of the past decade, ending their $11.4 billion joint venture to build EV battery plants in the United States as demand for electric vehicles softens and federal policy signals shift.

The move marks a sharp reversal from 2021, when Ford and SK On announced plans to construct multiple battery plants in Tennessee and Kentucky, a deal that was widely seen as a cornerstone of Ford’s long-term electrification strategy. At the time, soaring EV sales projections, generous federal incentives and tightening fuel economy standards pushed automakers to move aggressively into battery production.

Four years later, the EV landscape looks far more uncertain.

EV Market Hits a Reality Check

Electric vehicle sales in the U.S. have slowed through 2025, with battery-electric vehicles accounting for less than 10 percent of new light-duty vehicle sales. After years of double-digit growth, EV sales have flattened and, in some months, fallen sharply year over year.

Industry analysts point to a combination of factors: the rollback or narrowing of federal EV tax credits, high interest rates that have pushed monthly payments higher, and ongoing consumer concerns about charging infrastructure and resale values. At the same time, revised federal fuel-economy standards are expected to give gasoline and hybrid vehicles more breathing room, easing pressure on automakers to rapidly expand all-electric lineups.

Hybrids, which offer improved fuel efficiency without the need for charging, have gained market share faster than full battery-electric vehicles — a trend automakers are now leaning into.

How the Breakup Will Work

Under the terms of the dissolution:

-

SK On will take full control of the Tennessee battery facility, known as the BlueOval plant.

-

Ford will assume ownership of two adjacent battery plants in Kentucky, previously part of the joint venture.

SK On formally initiated the move to dissolve the partnership but says it plans to continue working with Ford around the Tennessee facility. The company says operating independently will allow it to improve productivity, increase operational flexibility and accelerate growth in its North American energy storage business.

Federal Loan Reassessed

The breakup also triggers a reassessment of a government loan originally approved at up to $9.6 billion to support the joint venture. Under the current administration, the loan is being restructured and reduced to limit taxpayer exposure and ensure faster repayment.

According to Bloomberg, the revised structure is designed to “reduce exposure to taxpayers and ensure prompt repayment.” Ford is working voluntarily with the U.S. Department of Energy to repay its portion more quickly than initially planned.

Ford’s EV Losses Mount

The decision comes as Ford continues to absorb heavy losses in its EV business. The automaker lost $5.1 billion before interest and taxes on its electric-vehicle operations in 2024 and expects losses to grow in 2025.

Chief executive Jim Farley has warned that under current market and policy conditions, U.S. EV sales could fall by as much as 50 percent, forcing automakers to slow investment and refocus on profitability.

“We believe the writing was on the wall this partnership was not going to work moving forward,” Wedbush Securities Managing Director Dan Ives told the Detroit Free Press. “Ford has to make some difficult moves, and this was a smart strategic one to rip the band-aid off.”

Michigan Impact: What It Means at Home

For Michigan, the breakup underscores the uneven pace of the EV transition — and the growing tension between long-term electrification goals and near-term economic realities.

Michigan remains the epicenter of U.S. auto manufacturing, with billions invested in EV assembly plants, battery research, and supplier retooling. But as EV sales slow, suppliers across the state face longer production timelines and increased uncertainty around volume forecasts.

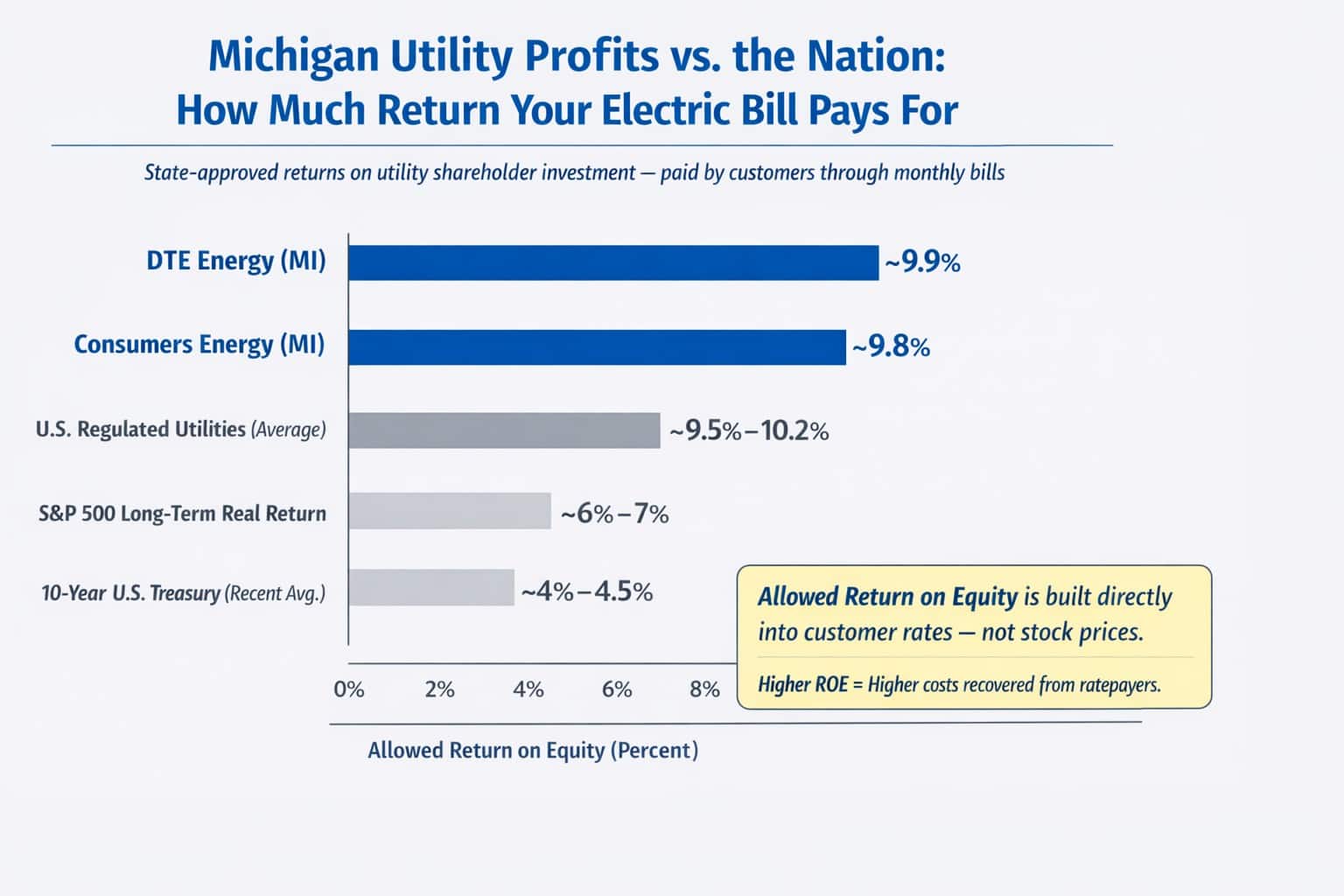

Utilities and regulators are also watching closely. Large-scale EV and battery investments have raised concerns about electric grid capacity, infrastructure costs, and ratepayer impacts, issues that have already sparked pushback in rural Michigan communities where data centers and energy-intensive facilities are proposed.

At the same time, Ford and other automakers are signaling a renewed emphasis on hybrids and advanced internal-combustion technologies — segments that support existing Michigan jobs while buying time for EV markets to mature.

A Strategic Reset, Not a Retreat

The end of the Ford–SK On joint venture does not signal an abandonment of electric vehicles. Instead, it reflects a broader recalibration underway across the auto industry as companies adjust to slower adoption, shifting policy priorities and the need for tighter capital discipline.

Battery makers are increasingly cautious about overcapacity, while automakers are dialing back the scale and pace of EV investments once assumed to be inevitable. In that context, the breakup stands as a clear marker of how quickly the EV boom has cooled — and how pragmatism is replacing ambition as the industry charts its next phase.

Michigan Supplier Impact: Pressure Builds Across the EV Supply Chain

The breakup of Ford’s battery joint venture with SK On is reverberating through Michigan’s automotive supplier ecosystem, where hundreds of companies have invested heavily to support the electric vehicle transition.

Many Tier 1 and Tier 2 suppliers across the state have spent the past several years retooling plants, retraining workers, and securing financing to meet anticipated EV production volumes. With EV sales slowing and production timelines stretching, those suppliers now face greater uncertainty around order volumes, pricing pressure, and return on investment.

Battery-related suppliers — including firms tied to cathode materials, thermal management systems, power electronics, and battery enclosures — are particularly exposed. Some companies had aligned capacity planning to Ford’s projected battery output, betting on rapid scale-up that has yet to materialize.

At the same time, suppliers focused on internal combustion and hybrid components are seeing steadier demand. Automakers’ renewed emphasis on hybrids has softened the impact for companies with diversified portfolios, while EV-only suppliers face sharper risk if volumes continue to underperform expectations.

Workforce implications are also emerging. While large-scale layoffs have not yet materialized across Michigan’s EV supply base, several suppliers have slowed hiring, delayed capital projects, or paused expansion plans as they wait for clearer demand signals.

Industry groups and economic developers say the situation underscores the need for flexibility and policy stability. Suppliers that can serve multiple propulsion platforms — EV, hybrid, and advanced ICE — are better positioned to weather the transition, while those tied exclusively to battery-electric vehicles may face a longer road to profitability.

For Michigan’s auto supply chain, the message is clear: electrification remains the long-term direction, but the near-term path is proving far less linear than once expected.