Market Demand and Consumer Trends:

Understanding market demand and consumer trends extends beyond a superficial overview of current market conditions. It requires a deep dive into the nuances of the industry and a forward-looking perspective. Investors should analyze historical sales data and industry reports to identify patterns and shifts in consumer preferences. They should also pay attention to emerging trends that could affect future demand, such as changes in regulations, advancements in technology, or shifts in socio-economic factors.

For example, an increasing focus on environmental sustainability has led to a surge in demand for eco-friendly products. Understanding such trends can provide insights into long-term market viability. Additionally, it’s important to consider the scalability of the product in different markets, both domestically and internationally. A product that resonates with a broader audience can offer greater growth opportunities. Investors should also be mindful of seasonal fluctuations in demand and plan accordingly. Ultimately, a thorough understanding of market demand and consumer trends can help investors predict the future trajectory of the manufacturing company’s products and make an informed decision about their investment.

Competitive Landscape:

Delving into the competitive landscape requires more than just knowing who the competitors are. It involves a comprehensive analysis of their strategies, strengths, weaknesses, and market positioning. This can be achieved through SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) of both the manufacturing company and its key competitors. Investors should evaluate how the company differentiates itself, whether through cost leadership, product differentiation, or niche market focus.

Understanding the barriers to entry in the market, such as capital requirements, technology, or customer loyalty, is also crucial. Moreover, investors should assess the company’s ability to adapt to changing market conditions and competitive pressures. For example, how quickly can the company innovate or pivot in response to a new entrant or a disruptive technology? Additionally, understanding the company’s supply chain resilience in the face of competitive pressures is vital.

A robust supply chain can be a significant competitive advantage in times of market volatility. Investors should also consider the future competitive landscape, including potential market entrants and the likelihood of industry consolidation. This comprehensive understanding of the competitive environment will help investors gauge the company’s potential for sustainable growth and profitability in a competitive market.

Financial Health and Profitability:

A thorough analysis of the company’s financial statements is critical. This should include assessing the company’s revenue trends, profit margins, cash flow, debt levels, and return on investment (ROI). A healthy balance sheet and consistent profitability are indicators of a well-managed company. Additionally, understanding the cost structure of the company, including fixed and variable costs, is essential to evaluate its financial resilience, especially in fluctuating market conditions.

Quality of Management and Workforce:

The success of a manufacturing company heavily depends on the quality of its management and workforce. Evaluating the experience, expertise, and track record of the company’s leadership provides insights into their capability to navigate challenges and drive growth. Additionally, the skill level and productivity of the workforce are crucial factors. A skilled and efficient workforce can significantly improve production quality and efficiency, directly impacting the company’s profitability.

Supply Chain and Vendor Relationships:

A robust and efficient supply chain is fundamental for manufacturing companies. Assess the company’s supply chain management, including its reliability, cost-effectiveness, and adaptability to changes in the market. Strong relationships with suppliers can lead to better pricing, quality materials, and reliable delivery schedules. Disruptions in the supply chain can have severe consequences on production and profitability, so understanding these risks is crucial.

Technology and Innovation Capabilities:

In a rapidly evolving industry, the technological capabilities of a manufacturing company are pivotal. Assess whether the company is keeping pace with technological advancements in its field. This includes the use of automation, AI, and other innovative manufacturing practices. Companies that invest in technology and innovation are often better positioned to improve efficiency, reduce costs, and stay competitive.

Regulatory Compliance and Risks:

Manufacturing companies are subject to various regulations, including environmental, health, and safety standards. Ensuring that the company complies with these regulations is essential to avoid potential legal issues and fines. Investors should also be aware of any pending litigation or regulatory changes that could impact the company’s operations.

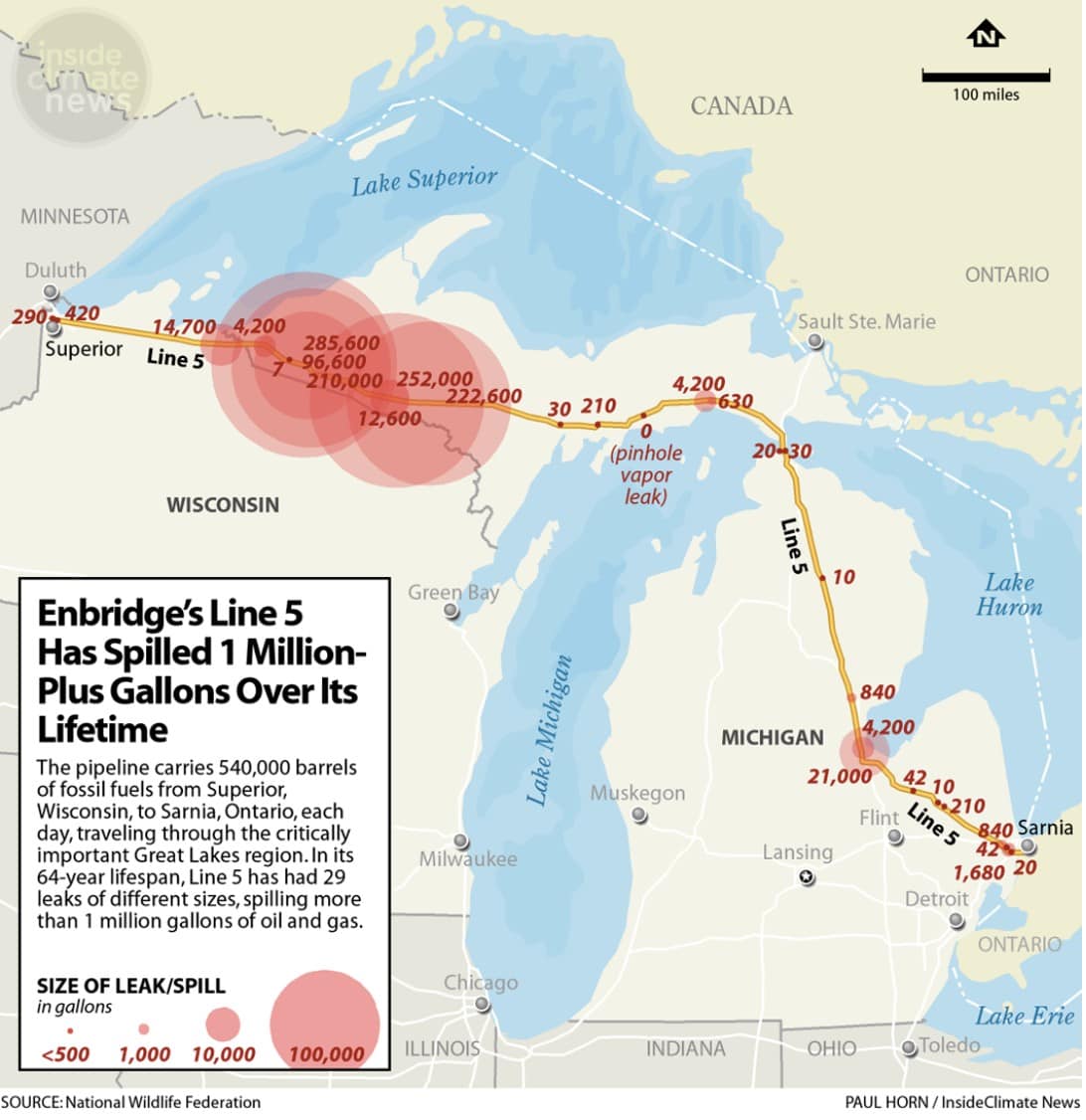

Environmental Sustainability and Social Responsibility:

Environmental sustainability and social responsibility are increasingly important in the manufacturing sector. Investors should assess the company’s practices in terms of environmental impact, energy efficiency, and sustainable sourcing. Companies with strong environmental and social governance (ESG) practices are not only contributing positively to society and the environment but are also often more appealing to modern consumers and investors.

Handling Systems and Operational Efficiency:

The efficiency of a manufacturing company’s operations is a significant factor in its success. This includes evaluating the company’s handling systems, production processes, and logistical capabilities. Efficient handling systems and operations can lead to reduced costs, faster production times, and higher product quality. Assessing how well the company manages its production and distribution processes is crucial in understanding its operational effectiveness.

Growth Potential and Expansion Plans:

Finally, understanding the company’s growth potential and future expansion plans is key to assessing its long-term viability. This involves evaluating the company’s strategic plan, potential for market expansion, new product development, and plans for reinvestment in the business. Companies with a clear and achievable growth strategy offer more potential for a successful and profitable investment.

In conclusion, investing in a manufacturing company requires a comprehensive evaluation of various aspects of the business. From market demand, competitive landscape, financial health, and management quality to supply chain efficiency, technological capabilities, regulatory compliance, ESG practices, operational efficiency, and growth potential – each aspect plays a crucial role in the overall assessment. By carefully analyzing these factors, investors can make informed decisions, mitigate risks, and position themselves for a successful venture in the manufacturing industry.